Table of Contents

A Non-Resident Indian (NRI) is an Indian citizen living abroad, also known as an Overseas Indian. The Foreign Exchange Management Act (FEMA) and the Indian Tax Act define NRIs for legal and tax purposes.

| According to FEMA, an NRI is someone who: |

|

Non-Resident Indian Meaning

NRI stands for Non-Resident Indian. Indian citizens living abroad are divided into three categories: Non-Resident Indians (NRIs), Overseas Citizens of India (OCIs), and Persons of Indian Origin (PIOs). Each category has its own rules to determine rights and status. To be classified as an NRI, there’s no specific application process. Anyone who meets the government’s guidelines can be considered an NRI. Key requirements include:

- Indian Passport: An NRI must have a valid Indian passport.

- Citizenship: NRIs must be Indian citizens, meaning you, your parents, or grandparents must have Indian citizenship.

- Spouse: You can also qualify if you are married to an Indian citizen or someone who meets these criteria.

Read More: Citizenship

NRI Under the Income Tax Act 1961

According to the Income Tax Act 1961, a person is considered an NRI if they do not meet certain residency conditions:

- Stay in India for 182 days or more in the previous year.

- Stay in India for 60 days or more during the previous year and 365 days in the last four years.

- If neither condition is met, the person is classified as an NRI for that year. The 2020 amendment changed the 60-day rule to 120 days for individuals earning over ₹15 lakhs, excluding foreign income.

Tax Rules for NRIs

- Taxable Income: NRIs must pay tax on income earned in India, but income from outside India is not taxed.

- Crew Members: Salaries of NRI crew members on foreign ships are not taxed in India.

- RNOR Status: Those returning to India can maintain their Resident but Not Ordinary Resident (RNOR) status for up to three years, exempting foreign income from taxes during that time.

In summary, NRIs enjoy various benefits while maintaining a connection to India, and understanding tax rules is essential for managing their finances.

Non-Resident Indians Eligibility Criteria

The eligibility criteria for NRI status are that the person should be an Indian citizen with a valid Indian passport and should reside outside of the Republic of India. Being an NRI is only a residential status classified by the Income Tax of India.

Benefits for NRIs

- First, the education system of India allows special reservation quotas for NRIs.

- Second, banks offer special overseas accounts like RFC/CNR/NRE/NRO for NRIs.

- Third, they can vote in elections in India by being physically present here.

- Fourth, income earned abroad is not taxable by the Income Tax Department of India.

Read More: Constitution of India

Why Do People Become NRIs?

A Non-Resident Indian (NRI) is an Indian citizen living abroad for various personal and professional reasons. Many choose this status because the Indian government offers several benefits, such as tax breaks, educational opportunities, and voting rights. NRIs can access special quotas in top educational institutes and have easier banking options, like opening NRE accounts for money transfers to India. Becoming an NRI is generally simpler than securing citizenship in another country, which involves more paperwork.

Disadvantages of Being an NRI

- Higher Taxes: NRIs have to pay taxes in the country they live in, which are often higher than Indian taxes.

- Fewer Benefits: NRIs receive fewer government benefits compared to regular Indian residents.

- Complicated Citizenship: It can be difficult for NRIs to get citizenship in their host country due to strict rules.

- Limited Tax Deductions: NRIs cannot claim certain tax benefits under the Income Tax Act 1961, such as:

- Investment under RGESS (Section 80CCG)

- Deductions for differently-abled individuals (Sections 80U, 80DD, and 80DDB)

Restricted Investments: NRIs are not allowed to invest in some savings schemes, including:

- Senior Citizen Savings Scheme

- National Savings Certificates (NSCs)

- Five-Year Post Office Deposit Scheme

- Public Provident Fund (PPF)

Read More: Fundamental Rights of Indian Constitution

Aadhar Card for Non-Resident Indian

Residents of India can currently enrol on an Aadhaar Card. OCI Cardholders who reside in India and stay there frequently (more than 182 days per year). Despite being Indian nationals, NRIs who have not lived in India for more than 182 days in a year are not eligible for an Aadhaar card.

Read More: Constituent Assembly of India

Person of Indian Origin (PIO)

A Person of Indian Origin (PIO) refers to a foreign citizen (except a national of. Pakistan, Afghanistan Bangladesh, China, Iran, Bhutan, Sri Lanka, and Nepal) who at any time held an Indian passport. Or. who or either of their parents/ grandparents/ great grandparents was born.

Read More: Reorganisation of States

Person of Indian Origin Eligibility Criteria

- The person has held an Indian Passport at any time; or

- The person who or either of his/her parents/ grandparents/ great grandparents were born and permanently resident in India.

- The definition of resident here is derived from the Government of India Act 1935.

- The External Affairs Ministry has barred residents of Pakistan, Bangladesh, Bhutan, Nepal, China, Iran, and Sri Lanka.

The PIO Card scheme was launched by the government to provide Persons of Indian origin with certain privileges. Indian Government on 9th January 2015 the Person of Indian Origin Card scheme was withdrawn and merged with the Overseas Citizen of India card scheme. PIO cardholders must apply to convert their existing card to OCI cards. PIO Card would continue to be a valid travel document in India till 31st December 2022.

Difference Between NRI, OCI and PIOs

| Element of Comparisons | Non-Resident Indian (NRI) | Person of Indian Origin (PIO) | Overseas Citizen of India (OCI) |

| Who? | An Indian Citizen who holds an Indian passport is living outside India. | A person or his ancestors were Indian in the past but now that person holds a passport of another country. | A person who holds an OCI card issued under the Citizenship Act 1955. |

| Which nationals are ineligible? | – | – | Pakistan, Bangladesh or any other country that is not allowed by the Government of India |

| What benefits one is entitled to? | All benefits of an ordinary Indian citizen | None |

|

| Visa requirement for visiting India | No | Yes | No |

| Requirement to register with local police authority | No | Yes if staying longer than 180 days in India. | No |

| What activities can one do in India? | All activities | Depending on the visa type | All activities except research work. Research work will need special permission. |

| How can one become an Indian citizen? | Already a citizen | As per Citizenship Act 1955, he/she has to live in India for at least 7 years before applying for citizenship | As per Citizenship Act 1955, he/she has to live in India for five years, in which he/she has to live in India for 12 months continuously before applying for citizenship. |

Party System in India, Feature, Importan...

Party System in India, Feature, Importan...

Consolidated Fund of India, Meaning and ...

Consolidated Fund of India, Meaning and ...

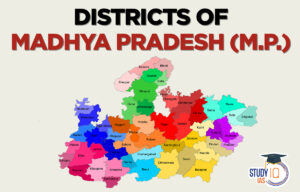

Districts of MP List, Name, Importance, ...

Districts of MP List, Name, Importance, ...