Table of Contents

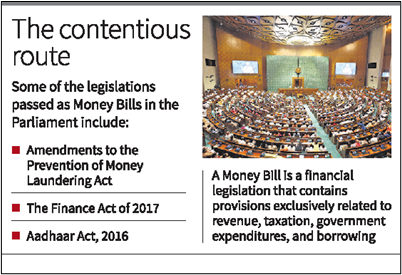

Context: The Supreme Court agreed to list petitions challenging the Money Bill route taken by the Centre to pass contentious amendments in the Parliament.

More in News

The contentious legislation passed as Money Bills:

- Aadhaar Act, 2016.

- Amendments to the Prevention of Money Laundering Act, 2002.

- Amendments to the Foreign Contributions Regulations Act, 2010.

- Finance Act, 2017 which brought about changes in the mode of appointment of judicial tribunals and also electoral bonds scheme.

The Money Bill is an important part of Indian Polity which is an important subject in the UPSC Syllabus. Students can also go for the UPSC Mock Test to get more accuracy in their preparations.

Money Bills

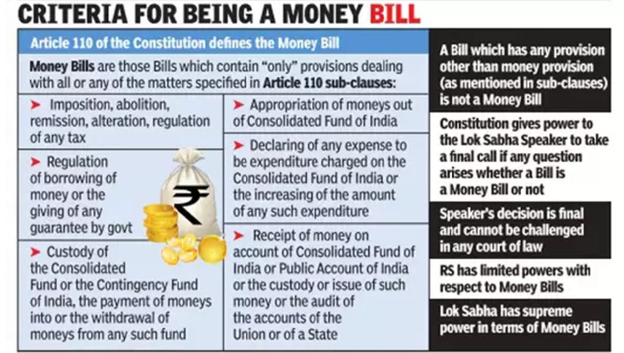

Article 110: It defines a Money bill.

- A money bill is a bill that, in the opinion of the Speaker of the Lok Sabha, deals with taxation or the appropriation of public funds — the Consolidated Fund of India or the Contingency Fund of India.

- Article 110(1)(a) to (f) defines a money Bill as a bill that contains ‘only’ provisions dealing with one or more of six specific matters:

- Taxation

- Borrowing by government

- Custody of consolidated fund or contingency fund

- Payment/withdrawal of money from such fund

- Appropriation out of the consolidated fund

- Expenditure charged on consolidated fund

- Receipt on account of a consolidated fund or public account or the audit of accounts of Union or States.

- A money Bill also includes any matter incidental to these specified subjects.

- Examples of money Bills include the Finance Act and the Appropriation Act which deal primarily ‘only’ with taxation and spending out of the consolidated fund respectively.

Procedure For Passage of Money Bill in Parliament

- Lok Sabha:

- Minister introduces the bill.

- Lok Sabha debates and votes on the bill.

- If passed, sent to Rajya Sabha.

- Rajya Sabha:

- Has 14 days to consider the bill.

- Can make recommendations, but cannot reject or amend.

- Returns bill to Lok Sabha with or without recommendations.

- Back to Lok Sabha:

- Lok Sabha considers Rajya Sabha recommendations.

- Can accept or reject recommendations.

- If accepted, the bill passed in modified form.

- If rejected or not returned within 14 days, the bill will be passed in its original form.

- President:

- Receives the passed bill.

- Can give or withhold assent, but cannot return for reconsideration.

- Normally assents to money bills due to prior permission.

|

Fact |

|

Money Bill Constitutional Provisions

Any tax that is levied, removed, paid, changed, or monitored. It controls how the GOI borrows money. Money Bill regulations govern the deposit of funds into and withdrawals from the Consolidated Fund of India (CFI) and the Contingency Fund of India (CFI).

It functions to appropriate funds from the CFI. The provisions of the Money Bill apply to the declaration of any CFI-charged expenses or an increase in the amount of any such expenditure. The Provision of Money bill governs the receipt of monies on behalf of the CFI or the public account of India, their custody or disbursement, or the audit of those accounts.

Any matter that is related to any of the above-mentioned matters comes under the Money bill. Article 110 of the Indian Constitution also specifies when a bill cannot be considered a money bill. These provisions are as follows:

- If a bill is used to impose fines or other monetary penalties, it is not referred to as a money bill.

- Licensing fees or fees for rendered services are sought or paid.

- Any tax levied, eliminated, paid, modified, or regulated by a local government or organisation for local goals.

Money Bill Types

Financial Bill

Each year, the Financial Bill, a bill that deals with financial issues including enacting new tax legislation, is introduced in the Lower House just after the general budget. It is introduced to Parliament along with the Annual Financial Statement.

Appropriation Bill

The Consolidated Fund may be allocated through this measure to the appropriate grants. This measure authorizes the spending and monies required to carry out grants that the House has approved.

Money Bill and Article 110

A money bill is defined as a draught submitted that principally comprises provisions that deal with all or any of the issues specified therein in Article 110 of the Indian Constitution. According to Article 110(3), the Speaker’s determination in any situation where there is a question as to whether a certain bill is a money bill or not is decisive.

When establishing whether a bill is a money bill, the speaker does not need to refer to anyone specifically. According to Article 110(4), the Speaker may acknowledge that a bill is a money bill when it is submitted to the Rajya Sabha and the President of India for his approval.

Differences Between Money Bill and Financial Bill

While Article 117 of the Indian Constitution governs money bills, Article 110 of the Constitution of India governs money bills. The table below provides a detailed explanation of the key aspects distinguishing money bills from money bills.

Two Categories under Article 117:

- Category I: Includes any of the matters specified in Article 110 along with other matters. They must be introduced in the Lok Sabha but require the assent of both houses.

- Category II: Involves expenditure from the Consolidated Fund but does not include the specific matters listed in Article 110. These also need approval from both houses.

Money Bill

The Speaker has the authority to determine whether or not a specific bill is a money bill. Financial Bills are the fundamental type of all money bills. The Rajya Sabha is unable to reject financial bills. Furthermore, the Council of States is not required to follow the Rajya Sabha’s rules while passing a money bill. The President must either accept or reject a monetary measure. There cannot be a combined session of the two Houses of Parliament.

Financial Bill

The Money Bills are exempt from the Speaker’s approval. Money bills cannot be regarded as all financial bills. A Financial Bill may be amended or even discarded by the Rajya Sabha. Even worse, the President might suggest that the Financial Bill be reevaluated before being sent back to the House. The President may summon a combined session if there is a tie.

| Money Bill | Financial Bill Category-I | Financial Bill Category-II |

| It is necessary to get the President’s prior recommendation. | The President must have recommended it in advance. | The President need not have recommended it in advance. |

| The Rajya Sabha’s ability to change or reject the Money Bill is constrained. | The Financial Bill Category-I may be modified or rejected by Rajya Sabha. | The Financial Bill Category-I may be modified or rejected by Rajya Sabha. |

| The Lok Sabha Speaker determines whether a financial bill qualifies as a money bill. | The Speaker’s approval is not necessary.. | There is no requirement for the Speaker’s approval. |

| It can only be brought up in Lok Sabha. | It can only be brought up in Lok Sabha. | Either the Lok Sabha or the Rajya Sabha can introduce it. |

| There is no provision for joint sitting. | There is a joint sitting option available. | There is a joint sitting option available. |

| The Constitution’s Article 110 to be dealt with. | Handled in accordance with Constitutional Article 117(1). | In accordance with Section 117(3) of the Constitution.. |

| Only provisions of Article 110 are discussed. | It also covers broad legal issues including the stipulations of Article 110. | It contains provisions for Consolidated Fund of India expenditures. |

| It is a Government bill. | It is an ordinary Bill. | It is an ordinary Bill |

Concerns related to Money Bill

- Scope of a Money Bill: The constitution stipulates that a money bill can only include matters of taxation, borrowing, expenditure, and other related issues.

- However, there have been instances where bills with broader implications have been introduced as money bills, which may not strictly adhere to these conditions.

- For e.g. Prevention of Money Laundering Act (PMLA) Amendments, Finance act, 2017, Aadhar Act 2016.

- However, there have been instances where bills with broader implications have been introduced as money bills, which may not strictly adhere to these conditions.

- Bypassing the Rajya Sabha: The government can pass important legislation without the need for approval from the Rajya Sabha by categorising a bill as a money bill. This can be problematic when the government lacks a majority in the Rajya Sabha and wishes to avoid the potential for amendments or rejection.

- Democratic Process and Federalism: The use of the money bill provision to pass wide-ranging legislation may undermine the role of the Rajya Sabha, which is crucial for the representation of states and for detailed legislative scrutiny, therefore impacting the federal structure and the legislative process intended by the constitution.

- Privacy and Security Risks: In cases like the Aadhaar bill, there were concerns about the risks to individual privacy and national security. Critics pointed out that such significant issues should warrant thorough legislative scrutiny beyond the Lok Sabha.

- Legislative Intent and Transparency: When laws that have far-reaching consequences are passed as money bills, it raises questions about the transparency and intent of the legislative process.

Judicial Scrutiny and Controversies

- Aadhaar Act (2016): This Act was controversially passed as a money Bill.

- It includes provisions for Aadhaar enrollment and authentication, establishment of an authority, and penalties for offences.

- Its classification as a money Bill was contested but upheld by a Supreme Court majority (4:1), with the current CJI dissenting, arguing it did not meet the strict definition of a money Bill.

- Finance Act (2017): This Act, passed as a money Bill, included amendments affecting the reorganisation of tribunals like the National Green Tribunal.

- The Supreme Court struck down these amendments in Rojer Mathew vs. South Indian Bank (2019), criticising the inadequate consideration of the ‘only’ criterion in the Aadhaar judgement and suggesting a larger bench to definitively resolve this legal question.

Implications and the Role of the Speaker

- The role of the Speaker in certifying money Bills has been pivotal and sometimes contentious.

- Critics argue that this power has been used to bypass the Rajya Sabha, especially in contentious legal reforms or amendments.

- The debates and judicial reviews highlight ongoing challenges in maintaining the balance of power between the houses of Parliament and ensuring legislative procedures are not exploited for expedient passage of controversial laws.

Way Forward

- Clear Definition and Guidelines: Establish a precise and stringent definition of what constitutes a money bill.

- Strengthening Rajya Sabha’s Role: Reinforce the importance and role of the Rajya Sabha in the legislative process.

- Enhanced Legislative Scrutiny and Public Consultation: Improve the transparency, accountability, and inclusiveness of the legislative process, addressing concerns about privacy, security, and other critical issues.

- Judicial Oversight and Review Mechanism: Ensure checks and balances within the legislative process, upholding the constitution and preventing executive overreach.

- Legislative Transparency and Intent: Foster a more transparent and accountable legislative process, allowing for informed debate and decision-making by legislators and the public.

Indian Secularism: Constitutional Provis...

Indian Secularism: Constitutional Provis...

India Mediation Campaign, Objectives, Pr...

India Mediation Campaign, Objectives, Pr...

Emergency Provisions in Indian Constitut...

Emergency Provisions in Indian Constitut...