Table of Contents

Context: According to data released by the National Statistical Office (NSO), retail inflation increased to 6.5% in January 2023.

About Retail Inflation

- It is measured by the consumer price index (CPI). The change in the price index over a period of time is referred to as CPI-based inflation, or retail inflation.

- CPI measures retail inflation by collecting data on the prices of goods and services that are consumed by the retail population of the country.

- The CPI monitors retail prices at a certain level for a particular commodity; price movement of goods and services at rural, urban and all-India levels.

- Among the major States, Telangana recorded the highest inflation in January at 8.6%, followed by Andhra Pradesh (8.25%), Madhya Pradesh (8.13%), Uttar Pradesh (7.45%) and Haryana (7.05%).

Causes for Spike in Inflation

- Higher Food Inflation: Consumer food prices increased to 5.94% from 4.2% in December 2022.

- Cereals inflation surged from 13.8% in December to 16.1%;

- Milk products accelerated from 8.5% in the previous month to 8.8%;

- Spices jumped from 20.3% inflation to 21.1% in January.

- Inflation in eggs sped from 6.9% in December to 8.8% in January, while the pace of price rise in meat and fish rose from 5.1% to 6.04%.

- Core inflation: It has increased to 6.2% in January from 6.1% in December.

- It is a measure of inflation arrived at by removing the prices of food and fuel.

CPI and Repo Rate

- CPI is an essential tool for RBI as it looks after the monetary policies of the country.

- The framework by RBI requires it to keep the inflation rate around 4% however it can fluctuate anywhere between 2% and 6%.

- The primary motive of RBI is inflation control, while it may change from time to time depending on the decision of the monetary policy committee.

Impact of Increase in Inflation

- Increase in Repo Rate: Reserve Bank of India (RBI) in February 2023 Monetary Policy meeting raised the repo rate by 25 basis points (bps) to 6.5 per cent in its fight against inflation.

- RBI raises the repo rate when it believes that inflation is not in control.

- Higher interest rates drag down overall demand for goods and services by making loans costlier. Lower demand is expected to cool down inflation.

- If inflation stays persistently high (‘sticky’), it would necessitate the RBI to keep raising interest rates

Sticky Inflation

- Inflation being sticky essentially means that inflation is taking longer than expected to fall.

- Higher food and fuel prices have spiralling impact on the broader economy and made other things costlier.

- However, India is not the only country facing sticky inflation.

- Many other countries such as the US and countries in the euro zone — are also struggling to come out from sticky inflation.

CPI vs. WPI

List of Governor of States in India, Con...

List of Governor of States in India, Con...

Daily Quiz 15 July 2025

Daily Quiz 15 July 2025

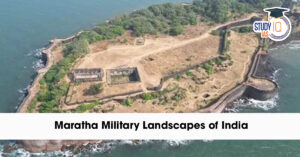

Maratha Military Landscapes of India Add...

Maratha Military Landscapes of India Add...