Table of Contents

What is Disinvestment?

Disinvesting is a tactic used by investors to sell or otherwise part with an asset or a share in it. An exit strategy called disinvesting is withdrawing from an existing investment. Governments frequently use disinvestment strategies to allocate resources more effectively. For instance, the Indian government declared that it will divest itself of its stake in BPCL, a state-owned oil and gas company.

The sale or liquidation of government-owned assets by the government through market activity is referred to as disinvestment. Typically, but not exclusively, such assets correspond to the Government’s ownership interest in Central Public Sector Enterprises (CPSEs) and State Public Sector Enterprises (SPSEs). Other fixed assets and project undertakings are included in the government’s assets.

Disinvestment in India Introduction

Disinvestment or divestment occurs when the government sells its holdings or a subsidiary, such as a Central or State public sector company. The three main disinvestment strategies are:

- Majority disinvestment

- Complete privatization

- Minority disinvestment

When minority disinvestment is in place, the government maintains managerial control by holding the majority of the company’s stock (usually more than 51%). Whereas in the event of a complete privatisation, the buyer acquires full ownership of the company, in the case of a majority divestment, the government passes control to the acquiring entity while holding onto a piece of the company.

Whether this means divestment or a reduction in funding, the major objective of disinvestment is to maximize the return on investment (ROI) connected to capital goods, labour, and infrastructure. Disinvestment is done for many different reasons, including strategic, political, or environmental ones.

Meaning of Disinvestment in India

In India, all issues pertaining to the administration of Central Government equity investments, including the disinvestment of equity in Central Public Sector Undertakings, are handled by the Department of Investment and Public Asset administration (DIPAM).

The Ministry of Disinvestment was established in 2001 after the Department of Disinvestment was established as a distinct Department in 1999. Since 2004, the Ministry of Finance has oversight of the Disinvestment Department. 2016 saw the renaming of the Department of Disinvestment to the Department of Investment and Public Asset Management (DIPAM). The four main focuses of its work included:

- Strategic Disinvestment

- Minority Stake Sales

- Asset Monetisation

- Capital Restructuring

It also covers all issues pertaining to the sale of Central Government equity in the formerly Central Public Sector Undertakings through an offer for sale, a private placement, or any other method. One of the Departments working for the Ministry of Finance is DIPAM.

Disinvestment in India and Privatization

The Strategic Disinvestment Policy of 2015–20 is supported by two major pillars: Strategic Disinvestment and the transfer of managerial power. The core of the disinvestment policy is the strategic disinvestment of CPSEs.

A central public sector company (CPSE)’s government stake of up to 50%, or a higher percentage as the competent authority may designate, would need to be sold as part of a strategic disinvestment, along with management control.

Disinvestment in India Types

Organizing the market segment: Because other divisions continue to provide higher profitability while requiring comparable resources and expenditures, a corporation may decide to stop investing in one of its underperforming divisions. With such a disinvestment plan, the corporation will concentrate more on its successful divisions and build them up.

Offloading unnecessary assets: When the purchase of an asset does not align with the company’s long-term plan, it is forced to use this tactic. After a merger, companies are left with assets they do not want to use. A business may decide to forego investing in newly acquired assets in favour of concentrating on its competitive advantages.

Social and legal considerations: If a company’s market holdings exceed a certain threshold, it might be required to reduce its investment to allow for fair competition. Another illustration is an endowment fund withdrawing from energy company investments due to environmental concerns.

Disinvestment in India: From a Government Point of View

Minority Disinvestment: By holding onto its majority ownership (equal to or greater than 51 percent), the government wants to keep managerial control over the business. The government must have the ability to influence corporate decisions in order to advance the interests of the general public because public sector businesses serve the needs of the people. Typically, the government offers the minority interest up for auction to possible institutional investors or publishes an offer for sale (OFS) that welcomes public participation.

Majority Disinvestment: In a government-owned business, the government forfeits its majority ownership. Following the disinvestment, the government is left with a small ownership position in the business. Such a choice is supported by government policy and strategic considerations. Most disinvestments are often made in favour of other public sector businesses. For instance, following the government’s disinvestment, Chennai Petroleum Corporation Limited, formerly known as Madras Refineries Limited, is a group business of Indian Oil Corporation. The concept is the pooling of resources inside a business, which eventually results in operational effectiveness.

Strategic Disinvestment: A PSU is often sold off by the government to a private, non-governmental company. The goal is to give more effective private market participants ownership of a failing organisation in order to lessen the financial strain on the government’s balance sheet.

Complete Disinvestment/Privatization: A PSU is privatised when the government sells its whole investment in it, transferring full ownership and control to the purchaser.

Disinvestment Policy of the Government

Previously, the Department of Disinvestment was a separate cabinet ministry. The Ministry of 2004 retained a separate department despite being integrated into the Ministry of Finance. The Department of Disinvestment was renamed Department of Investments and Public Asset Management (DIPAM) later in 2016 by the BJP-led government.

DIPAM’s main responsibilities include managing the Central Government’s equity stake in PSUs and carrying out disinvestment activities in accordance with the annual targets established by the Finance Ministry.

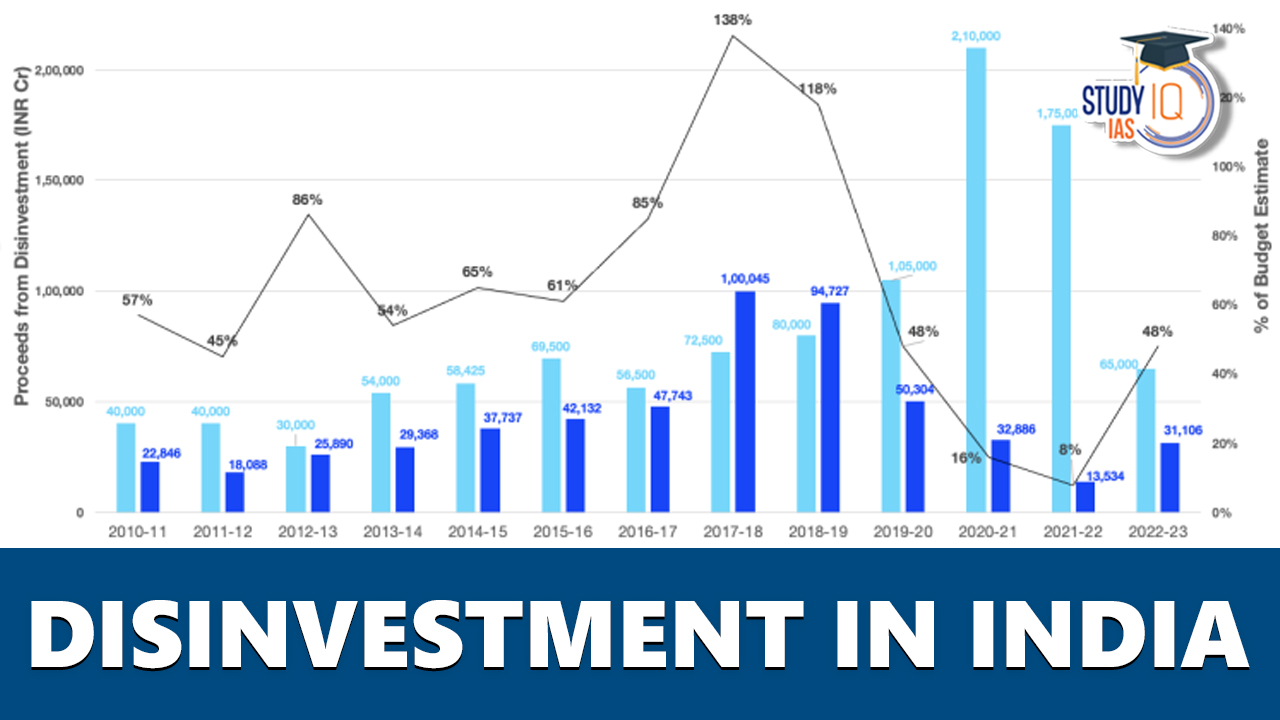

Every year, the government includes a target for disinvestment in its budget for the upcoming fiscal year, and the targeted amount is actually disbursed. Less below the disinvestment aim of Rs. 65,000 crores established in FY23, the disinvestment target for FY24 is set at Rs. 51,000 crores.

The features of the disinvestment policy in India as per DIPAM are as follows:

- Encourage minority disinvestment or strategic disinvestment in CPSEs to increase and assure responsibility to the Indian public.

- CPSEs must be listed if they have three consecutive years of net profit and have no accumulated losses, and they must meet the minimum public shareholding level of 25% through an OFS, FPO, or a combination of the two.

- Disinvestment will be explored for CPSEs on a case-by-case basis, and CPSEs will be identified for divestiture after consultation with the relevant ministries that are in charge of managing such CPSEs.

- Niti Aayog, the government think tank, is to be seen as a major party monitoring discussions of strategic disinvestment suggestions and means.

- OFS of Government equity recommendations will be evaluated by the Government.

- Niti Aayog will suggest CPSEs that need strategic disinvestment, as well as the method of sale, the percentage of the company that needs to be sold, and the valuation of such CPSEs.

All of the money from the disinvestment of CPSEs went to the National Investment Fund (NIF), which was first established in 2005. NIF was established as a permanent fund with professional management to achieve the dual goals of supporting social welfare schemes (which accounted for 75% of the fund corpus) and satisfying the capital needs of successful PSUs (25% of the fund corpus). However, following the financial crisis of 2008 and the depletion of the fund for social welfare, the fund was realigned in 2013 to the government’s disinvestment agenda. Currently, NIF is a ‘Public Account’ under the Government Accounts and is only withdrawn from or invested in for pre-approved reasons of:

- Subscription to CPSE assignment of preferred stock to preserve Government shareholding of 51%; Participation in rights offerings of listed CPSE to maintain majority control;

- Recapitalization of PSBs and public sector financial institutions as and when the need for capital injection arises.

- Meet the CAPEX requirements of Indian Railways;

- Infuse capital into metro projects;

- Invest in development organisations like NABARD, Exim Bank, RRBs, etc.

Disinvestment Policy of the Government

The 1956 Industrial Policy Resolution and the second five-year plan marked the beginning of the focus on public sector businesses. Following the implementation of structural reforms, globalisation, and economic liberalisation in 1991, disinvestment as a governmental effort got its start. The administration of PV Narasimha Rao launched a disinvestment programme in 1991 and said it would sell up to 20% of its equity in some PSUs, primarily through mutual funds and FIIs (Financial Institutions Investors).

More people, including FIIs and company employees, were permitted during the subsequent phase of the disinvestment. The C. Rangarajan Committee was constituted and advocated for a 49% disinvestment. During the Atal Bihari Vajpayee administration, significant disinvestment-related reforms took place, including the selling of stakes in Paradeep Phosphates, Hindustan Zinc, and BALCO. In 2005, the National Investment Fund was established, into which the proceeds from disinvestment were directed. To make use of the investments in new projects, a new disinvestment policy was envisioned. The “Department of Investment and Public Asset Management” (DIPAM) replaced the “Department of Disinvestment.”

Recent Trends in Disinvestment Policy

In comparison to the 1.75 lakh crore estimated in the budget estimate (BE) on February 1 of last year, the government has lowered its disinvestment forecast for the current financial year to 78,000 crores, a fall of 55.4%. The disinvestment goal is Rs 65,000 crore for 2022–2023. The revised projection for 2021–22 (Rs. 78,000 crore) is 17% higher than this.

The entire disinvestment government proceeds to date is $12,029.9 crore, of which $2,700 crore came from the privatisation of Air India and the remaining $9,330 crore came from the sale of minority holdings in CPSEs. Major disinvestments are scheduled for the current fiscal year (2022), including the initial public offerings of LIC, BPCL, RINL, and Pawan Hans.

NATO Countries List 2025, Members, Funct...

NATO Countries List 2025, Members, Funct...

UPSC Prelims Syllabus 2025 PDF, Check Su...

UPSC Prelims Syllabus 2025 PDF, Check Su...

UPSC Toppers 2024 Felicitation Program b...

UPSC Toppers 2024 Felicitation Program b...