Table of Contents

Context: The Centre has selected sites in Tamil Nadu, Telangana, Karnataka, Gujarat, Maharashtra, Madhya Pradesh and Uttar Pradesh to set up mega new textile parks, a year and a half after the PM MITRA scheme was announced.

About the PM Mega Integrated Textile Region and Apparel (PM MITRA) Scheme

- Launch: The scheme was first announced in the union budget speech of 2021-22, under which seven mega textile parks are proposed to be set up to make Indian textile sector globally competitive.

- Mega Textile Parks are designed to integrate the entire textile value chain, from spinning, weaving, processing/dyeing and printing to garment manufacturing, all within a single location.

- Objective: The main objective of the Mega Textile Parks is to create an ecosystem that promotes competitiveness, productivity, and innovation in the textile industry.

- Outlay: The total outlay for the project is ₹4,445 crore, though the initial allocation in the 2023-24 Budget is only ₹200 crore.

- Key features of the scheme:

- 5F Vision: The PM MITRA scheme is Inspired by the 5F vision – Farm to Fibre to Factory to Fashion to Foreign.

- PM MITRA park will be developed by a Special Purpose Vehicle which will be owned by the Central and State Government and in a Public Private Partnership (PPP) Mode.

- The Ministry of Textiles will provide financial support through development capital support up to Rs. 500 crores per park to the Park SPV.

- A competitive incentive Support (CIS) of up to Rs 300 crore per park to the units in PM MITRA Park shall also be provided to incentivise speedy implementation.

- Each MITRA Park will have an incubation centre, a common processing house, a common effluent treatment plant, and other textile-related facilities such as design centres and testing centres.

- Sites for PM MITRA Parks will be selected by a Challenge Method based on objective criteria.

- Significance of the scheme:

- Reduce Logistics Cost: It will reduce logistics cost and strengthen the value chain of the textile sector to make it globally competitive.

- Investment and employment generation: The Centre envisages an investment of nearly ₹70,000 crore into the parks, with employment generation for about 20 lakh people.

- Self-reliance: It aspires to fulfil the vision of building an Aatmanirbhar Bharat and to position India strongly on the Global textiles map.

- UN SDG9: The parks will help India to achieve the UN Sustainable Development Goal 9: “Build resilient infrastructure, promote sustainable industrialization and foster innovation”.

Overview of Indian Textile Industry

- Textile sector contributes 2.3% to Indian GDP, 7% of the Industrial Output, 12% to the export earnings of India.

- India is the largest producer of cotton & jute in the world, the second largest producer of silk in the world the 6th largest producer of Technical Textiles.

- 95% of the world’s hand-woven fabric comes from India.

- India has a share of 5% of the global trade in textiles and apparel.

- It provides direct employment of over 45 million people (21 % of total employment) and source of livelihood for over 100 million people indirectly.

Locational Factors for the Textile Industry

- Six geo-economic factors on which the localization of textile industry depends are as follows: 1. Climate 2. Power 3. Raw Material 4. Labour 5. Transport 6. Markets.

Challenges faced by the Textile Sector in India

- High fragmentation: The textile industry in India is characterized by high fragmentation, with the unorganized sector and small and medium enterprises dominating the sector.

- Infrastructure bottlenecks: Inadequate infrastructure, such as poor transportation facilities and power shortages, increases the cost of production and reduces the competitiveness of the Indian textile industry.

- Technology Obsolescence: Many textile units in India still use outdated technology, making them less competitive than their counterparts in other countries.

- Highly competitive export market: In the global market tariff and non-tariff barriers coupled with lack of free/preferential trade agreements are posing a major challenge to the Indian textile Industry.

- There is fierce competition from China, Bangladesh and Sri Lanka in the low-price garment market.

- Impact of Goods and Services Tax (GST): GST has created distortions in the Textile and Apparel sector in India, impeding its competitiveness.

- For instance, man-made fibres (MMF) are taxed at 18 per cent for fibre, 12 per cent for yarn and 5 per cent for fabric. This inverted tax structure makes MMF textiles costly.

- Environmental issues: Textile processing, which heavily relies on non-biodegradable chemicals and consumes vast amounts of water, poses significant environmental challenges.

Initiatives by the Government for Growth of Textile Industry

| Technology Upgradation | Amended Technology Fund Upgradation Scheme (ATUFS) to upgrade technology/machineries of textile industry. |

| Sector Specific Missions | National Handloom Development Programme providing basic inputs, looms and accessories, design and development, infrastructure development, marketing of handloom products, etc.

National Technical Textiles Mission has been approved for creation at a total outlay of Rs.1480 Crore with a four-year implementation period from FY 2020-21 to 2023-24. |

| Capacity Building and Social Security | SAMARTH (Scheme for Capacity Building in Textile Sector) for skill development in the entire value chain of textiles, excluding Spinning & Weaving in the organized Sector.

Scheme for Incubation in Apparel Manufacturing (SIAM) to promote new entrepreneurs in apparel manufacturing. Scheme for Textile Industry Workers’ Accommodation (STIWA) to provide safe, adequate and conveniently located accommodation for textile and apparel industry workers in the proximity of areas of high concentration of textile and apparel industries. |

| Other measures | Scheme for Remission of Duties and Taxes on Exported Products (RoDTEP): It will take under its ambit refund of GST taxes and import/customs duties for inputs along with VAT on fuel used in transportation, mandi tax, duty on electricity used during manufacturing.

100% FDI (automatic route) in the textile and apparel sector in India. Removal of anti-dumping duty on PTA (Purified Terephtallic Acid), a key raw material for the manufacture of MMF fibre and yarn to boost exports in MMF sector. |

DRDO and Air Force Successfully Test Ind...

DRDO and Air Force Successfully Test Ind...

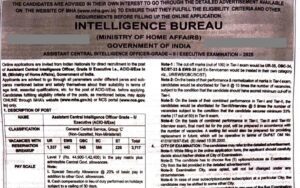

IB ACIO Recruitment 2025 Notification Ou...

IB ACIO Recruitment 2025 Notification Ou...