Table of Contents

Context: The article discusses India’s digital public infrastructure (DPI), which includes the India Stack and other related initiatives. It notes that the DPI is a result of a unique partnership between various stakeholders such as governments (Union and States), the private sector, volunteers, startups and academia/think tanks and that this collaboration has led to sustained collective action at scale. The article also suggests that DPI may even be superior to Web 3 which is the next generation of the internet that is being developed with a focus on decentralization, privacy, and security.

Background

Understanding Digital Public Infrastructure:

- What is DPI: It refers to an open-source identity platform that can be used to access a wide variety of government and private services by building applications and products.

- It includes digital forms of ID and verification, civil registration, payment (digital transactions and money transfers), data exchange, and information systems.

- These public digital platforms are customisable, localizable, interoperable and leverage public data for open innovation models.

- For example, Unified Payment Interface (UPI) architecture’s interoperability is resonated in over 300 banks offering linkages to bank accounts through UPI which is accessed by consumers via 50-plus third-party apps.

- Principle: The platforms in DPI are based on core principles of consent-based data sharing protocols, openness, equity, inclusivity, fairness, transparency and trust hence reducing the digital divide.

- Significance: Because of DPI’s low-cost and inclusive platforms, India has been able to push the boundary of public service delivery and digitally leapfrog, with the public sector defining regulatory limits and the private sector innovating and competing in the marketplace.

- DPI also allows nations to retain strategic control over their digitalisation processes, ensure digital cooperation and strengthen long-term capacity.

- A recent study by the Bank for International Settlements (BIS) has highlighted that on account of the DPI, India has delivered in 10 years what would have taken 50 years to achieve.

- The analysis by the Centre for Digital Economy Policy Research (C-DEP) estimates that national digital ecosystems could add over 5% to India’s GDP.

- Applications: India is seen as a global trendsetter in the DPI movement, having set up following multiple large-scale DPIs in contrast to the tech innovations that earlier emerged from the developed world:

- JAM trinity which links Aadhaar, mobiles and bank accounts

- Digi Locker for digital storage and documents

- Bharat Bill Pay, a one stop solution for multiple payments

- UPI, Aadhaar Enabled Payment Systems (AePs) and Immediate Payment Service (IMPS)

- CoWin for vaccination

- Predominant DPIPs in India: The five predominant DPIPs that are currently in operation in India, namely, Aadhaar, Unified Payment Interface (UPI), Ayushman Bharat Digital Mission (ABDM), Digital Infrastructure for Governance, Impact & Transformation (DIGIT), and the Account Aggregator (AA) Framework. Their performance has been analysed as per the ‘State of India’s Digital Economy Report (SIDE) 2023’.

| DPIPs | Performance |

| Aadhaar | Provided a massive boost to financial inclusion in India.

The country has reached significantly high levels of bank account ownership, closing the gap between the rich and the poor and between men and women. The scheme has led to an overall savings of INR 2 trillion. Aadhaar through e-KYC has also brought down costs of verification, leading to savings in costs for customer acquisition from INR 500 – 700 per person to INR 3. |

| The Unified Payments Interface (UPI) | Real-time interoperable payments system, which has seen unprecedented growth, especially for peer-to-peer (P2P) transactions.

UPI has introduced features such as UPI123 and UPILite to make the ecosystem more inclusive. |

| Ayushman Bharat Digital Mission (ABDM) | While Co-Win platform saw phenomenal success, the registration of health IDs and linking of electronic health records has been relatively slow and regionally dispersed.

The system currently is completely driven by public sector institutions unlike most other DPIs in India. E-Sanjeevani, the government’s telehealth platform, is a rising star and stands out in terms of the share of female users, compared to many other private sector platforms. |

| Urban Platform for deliverY of Online Governance (UPYOG) | It is a platform designed to enhance the operational capacity of rural and urban local bodies, municipalities, and cantonments in India.

It is built using the Digital Infrastructure for Governance, Impact & Transformation (DIGIT) core. UPYOG aims to integrate these different bodies into a central system to enable efficient online governance and service delivery. The platform could potentially streamline administrative tasks, provide greater access to government services and information, and enhance the overall effectiveness of local government bodies in India. Improvements in development outcomes are slowly becoming visible. |

| Account Aggregator Framework (AAs) | Built on the Data Empowerment and Protection Architecture (DEPA) is a new class of intermediaries that facilitate data sharing based on valid consent from individual users.

From the latest data available, 4.02 million bank accounts have been linked to AAs and the cumulative count of consent requests successfully fulfilled is 3.9 million. According to industry estimates, 50 per cent of the lending disbursed through AAs were to MSMEs and that the cost of loan processing has declined by 75 per cent from INR 440 to below INR 100. |

- India’s DPI push in Union Budget 2022: 4 Key Announcements were made in Budget 2022 to promote India’s Digital Public Infrastructure.

- Health: An open platform with digital registries, a unique health identity and a robust consent framework.

- Skilling: A Digital Ecosystem for Skilling and Livelihood (DESH-Stack) to help citizens upskill through online training.

- Unified Logistics Interface Platform (ULIP): To streamline movement of goods across modes of transport and for travel.

- Mobility: An “open source” mobility stack for facilitating seamless travel of passengers.

Decoding the Editorial

The Article focuses on the take-off of Aadhar and on what is coming next for India’s DPI and the potential drivers of the same. It notes that more digital systems and technologies have been added to the original foundation of Aadhaar, creating a superstructure that delivers consistent, affordable, and valuable services to citizens, the government, and the corporate sector. This infrastructure can be used imaginatively wherever it is implemented. It acknowledges how Aadhaar expanded its scope and allowed it to become a tool for good governance today, currently accounting for 1,700 government schemes at both the union and state level using Aadhaar as a foundation to deliver services to citizens. In other words, Aadhaar has become a crucial component of India’s digital infrastructure, enabling efficient and effective delivery of services to citizens.

Other Dimensions of the Article:

- Aadhar and the Private Sector:

- The article throws light on how the Supreme Court’s landmark judgement in Puttaswamy vs Union of India, 2018 that emphasized the importance of privacy, resulted in a slowdown in the use of Aadhaar by the private sector.

- The Court unanimously held that Indians have a constitutionally protected fundamental right to privacy that is an intrinsic part of life and liberty under Article 21.

- However, due to the convenience and ease of use that Aadhaar provides in everyday transactions, there has been a gradual opening up of Aadhaar for voluntary use in the private sector.

- This means that individuals can choose to use their Aadhaar for private sector purposes, and private sector entities no longer need special permission for such usage.

- This shift towards greater use of Aadhaar in the private sector will lead to further innovation and growth in India’s digital infrastructure.

- The article throws light on how the Supreme Court’s landmark judgement in Puttaswamy vs Union of India, 2018 that emphasized the importance of privacy, resulted in a slowdown in the use of Aadhaar by the private sector.

- DigiYatra and DigiLocker:

- DigiYatra: The article compares the DigiYatra program in India, which is a free Biometric Enabled Seamless Travel (BEST) experience based on facial recognition technology, to the United States’ CLEAR program, which is a paid expedited airport security/identity verification process.

- The DigiYatra program has been successful in facilitating seamless identification of passengers at key checkpoints in airports, and has already been used by about two lakh passengers.

- The article suggests that if DigiYatra reaches a third of India’s air passenger traffic, it will lead to further innovation and second-order effects.

- DigiLocker: The article also discusses how the DigiLocker program in India, which allows users to store and share documents digitally, has been instrumental in simplifying government processes such as passport applications and police recruitment drives in Karnataka.

- It notes that if an Enterprise DigiLocker can be created, it can lead to significant cost savings and simplify compliance procedures for businesses.

- DigiYatra: The article compares the DigiYatra program in India, which is a free Biometric Enabled Seamless Travel (BEST) experience based on facial recognition technology, to the United States’ CLEAR program, which is a paid expedited airport security/identity verification process.

- Impact of UPI: Unified payment interface (UPI) in India, has been growing rapidly in recent years under the leadership of the National Payments Corporation of India.

- UPI is a mobile-based payments system that allows users to transfer money instantly between bank accounts using their smartphones.

- It is noted that UPI has now crossed eight billion transactions per month and transacts a value of $180 billion a month, which is approximately 65% of India’s GDP per annum.

The article here raises a question about the impact of UPI on India’s GDP. Specifically, it asks whether the growth of UPI is impacting GDP significantly or whether it is GDP neutral. The answer to this question is twofold:

- On the one hand, it is possible that UPI is simply displacing existing payment methods, such as cash and traditional bank transfers, without significantly increasing the overall volume of transactions. If this is the case, then UPI’s impact on GDP would be relatively limited.

- On the other hand, it is also possible that UPI is bringing new users into the formal financial system and enabling them to make payments and engage in economic activity that they were previously unable to do. If this is the case, then UPI could be expanding the overall size of the payment market and contributing to GDP growth.

- Overall, the impact of UPI on India’s GDP is likely to be complex and multifaceted.

Beyond the Editorial

The Digital Public Infrastructure (DPI) of India is revolutionizing the way people conduct day-to-day transactions, leading to economic freedom and growth. It has become the backbone of India’s business ecosystem and is expected to help the country reach a $25 trillion economy by its 100th year of independence. The integration of ChatGPT and India Stack, the technology behind DPI, could lead to further innovation and growth.

Step to further improve Adaptability of Digital Public Infrastructure (DPI)

- Bridge Digital Divides: Multimodal access (feature phone, smartphone, computer) must be prioritised to accommodate for varying levels of digital access that might exist between different social groups.

- Example: National Payments Corporation of India launched the UPI123Pay Service to allow feature phones without an internet connection to use UPI.

- Sustainable Financing: Developing a long-term financing model will be critical in ensuring the sustainability of DPI.

- Public resources are preferable for the development and maintenance of the ‘core infrastructure’ at the national level as this infrastructure must remain accountable to the wider population due to its pivotal role in enabling public service delivery.

- Innovative financing mechanisms such as setting up a sovereign tech fund or using blended finance instruments could also be considered to finance resilient DPI.

- Innovative approaches like the open digital ecosystems (ODE) framework to make critical choices on both tech and non-tech layers so that DPI can be deployed to meaningfully work towards society’s well being.

- New tools of DPI based on a whole-of-society approach: For example, the multi-stakeholder initiative GovStack develops a secure and standard-based approach to enable countries to kickstart their digital transformation journey by adopting, deploying and scaling digital government services.

- New models of digital cooperation: The joint management and maintenance of DPI by sovereign entities requires collaboration between countries on strategic decisions like choice, data portability, interoperability etc., to create and support new models for digital cooperation.

- People-centric approach: While prioritizing investments in DPI, effort should be made for inclusivity focusing on equity, good governance, and regulatory frameworks to ensure that no one is left behind.

- A 2021 report by the Digital Public Goods Alliance outlined a vision for DPI that safeguards inclusion, trust, competition, security, and privacy, public value and private empowerment.

- Engaging local stakeholders: Such as universities and accelerators to work with government partners could help in long-term capacity investment in DPI implementation and maintenance.

- Global cooperation: In 2022, UN Development Programme, the Digital Public Goods Alliance and countries from around the world committed to sharing best practices for the implementation of DPI.

DRDO and Air Force Successfully Test Ind...

DRDO and Air Force Successfully Test Ind...

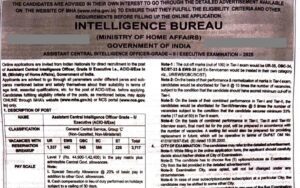

IB ACIO Recruitment 2025 Notification Ou...

IB ACIO Recruitment 2025 Notification Ou...