Table of Contents

Context: NHAI has released a comprehensive road map for asset monetisation in the roads sector paving way for unlocking value and generating funds for further investment in the roads sector. NHAI has raised over Rs 1.4 lakh across using the asset monetisation strategies of Toll-Operate-Transfer, InvITs & Securitisation models under the National Monetisation Pipeline.

Asset Monetisation

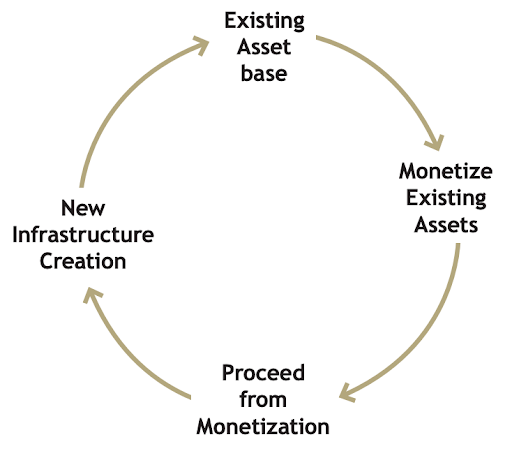

Asset Monetisation (also known as asset or capital recycling) entails a limited period license/lease of a public sector asset to a private sector entity for an upfront or periodic consideration through a well-defined concession or contractual agreement.

Note: The Development of national highways has a multiplier effect on the economy by facilitating trade and increasing the overall economic development of a region.

(Infrastructure Asset Monetisation Cycle)

Significance of NHAI’s Asset Monetisation Strategy

- Unlocking of economic value: The Economic value of completed road assets is unlocked, leading to the generation of funds for future investment in new road projects.

- Reducing fiscal pressure for road development: Traditional budgetary support from the Union Government and toll revenues accounted for the funding development of National Highways in India. For example, in FY 24-25, budgetary support and toll revenues accounted for 93% of total funds with NHAI. Asset Monetisation will result in attracting private capital in the National Highway sector for further accelerating road development.

- Efficiency improvement by:

- Attracting private sector expertise in operations & management of road infrastructure

- Boosting the quality of roads due to better maintenance

- Leverage of advanced technologies

- Increased longevity of road assets

- Ensuring trust, transparency & fair competition in asset monetisation by integration of better O&M and technologies by the private sector.

- Supporting National Monetisation Pipeline

- Deepening of the infrastructure financing ecosystem

Asset Monetisation Strategies Employed by NHAI

1. Toll – Operate – Transfer (TOT)

This model is structured to attract private capital for the management of completed projects, in exchange for toll collection rights. The concessionaire pays a lump sum amount to NHAI at the start of the concession and also undertakes operations & management obligations for the asset during the duration of the concession period.

Benefits to NHAI

- Upfront payment of the concession fee leads to quick infusion of capital for future road development.

- Efficiency in O&M with the private sector bringing best practices to enhance road user experience, road longevity and safety.

2. Infrastructure Investment Trusts (InvITs)

InvIT is a pooled investment vehicle that raises funds from investors by issuing units. Infrastructure asset owners use InvITs to pool funds from a diverse set of investors, who receive cash flow generated by the assets periodically. They are regulated by the SEBI.

Benefits of InvITs

- Stable and predictable cash flows.

- Low risk

- Liquidity

- Diversification

- Tax benefits to investors

- Greater confidence and trust, as regulated by SEBI

- Stable and predictable cash flows.

3. Securitisation of Projects

Under this strategy, NHAI raises long-term finance from banks by securitising user fee receipts from toll plazas. For example, for the construction of the 1,337 km Delhi-Mumbai Expressway, NHAI has formed a Special Purpose Vehicle (SPV) to securitise the corridor’s future revenues and raise funds for its development and raised Rs 40,000 crores through this mechanism.

Outline of NHAI’s Asset Monetisation Strategy 2025-30

The objective of NHAI’s Asset Monetisation Strategy is to:

(i) Streamline processes: Strategy for simplification and standardisation of processes involved in asset monetisation.

(ii) Enhance transparency: Measures to enhance transparency in all transactions and operations.

(iii) Mitigate risks: Identification of potential risks associated with asset monetisation and development of strategies for risk mitigation.

The three pillars of NHAI’s asset monetisation strategy are: (i) Value Maximisation (ii) Transparency (iii) Market Development.

1. Value Maximisation

Ensuring maximisation of the value of public assets by creating standardised processes to identify and offer attractive assets for monetisation.

- Creation of Asset register: Identification of a list of highways which will be attractive for investors to participate in NHAI’s asset monetisation program. Criteria for filtering out assets to be included in the asset register:

- Age of Asset: Already in operation for at least 1 year, enabling assessment of operational and financial history.

- Nature of stretch: Complete with no requirements for enhancement works in the near future.

- Revenue: Should have significant toll revenue to sustain positive cash flows and returns for concessionaires. Assets with toll revenue of more than Rs 0.8 cr/km to be considered.

- Historic Revenue Growth: Assets should have steady and stabilised revenue growth for reducing unpredictability and risk, and increasing bankability for investors. Thus, assets with a stable pattern of traffic growth will be offered.

- Technical & Traffic evaluation of the asset: Result in maximisation of value of the asset and also highlight issues that may come in monetisation of the asset to be addressed well in advance.

-

- Technical investigations to be done by using drone videography, mobile LIDAR surveys, axle load surveys, and network survey vehicles (NSV). Spatial planning platforms such as the PM Gati Shakti National Master Plan portal will also be leveraged.

- A traffic volume count survey is to be done on the asset to determine its traffic volumes, which will in turn feed into the calculation of the project’s Initial Estimated Concession Value (IECV).

- The asset Monetisation Cell of NHAI will be employed for conducting technical and commercial evaluations.

- Transaction Value of ToT bundles: To maximise the value attributed to NHAI, the Free Cash Flow to Firm (FCFF) method will be employed.

- Categorisation of Assets: Following the traffic and technical assessments, assets will be categorised into various classes based on toll revenue per km and toll revenue growth rate. These classes will help in creating a balanced bundle of assets.

- Identification of monetisable assets: Shortlisted assets will be pooled together to create bundles of sizable value, which are attractive to investors. The bundles will be created with the aim of balancing immediate returns with future growth, preferably located to provide geographical advantages, and the sizes of bundles will be varied to suit the needs of different segments of investors.

- Execution of monetisation process: Following the creation of bundles, an assessment will be made as to which route to be employed for monetisation – Toll Operate Transfer or InvIT.

- Timing & frequency of operations: Bundles will be issued on an annual basis by NHAI, depending on prevailing market conditions, following assessment of market capacity & due diligence.

2. Transparency

Essential for building trust among investors. These strategies focus on building transparency both within NHAI and in communications with investors.

- Standardisation & Dissemination of Processes & Documents across the value chain, including pre- and post-bidding stages.

- Public dissemination of relevant investor information about NHAI’s future monetisation pipeline, macro-economic factors, and assumptions for estimating future toll revenues for monetisation bundles.

- Asset Monetisation Cell set up by NHAI will be used as the information backbone for NHAI for managing the dissemination of information by:

- Public disclosure of future monetisation pipeline.

- Full disclosures of assumptions made to arrive at IECV.

- Continuous monitoring and performance evaluation by establishing KPIs, regular reporting and review, risk monitoring and mitigation and feedback mechanisms.

3. Market Development

Aims to (i) broaden the investor base to attract more private participation, (ii) enhance stakeholder engagement to increase the traction of NHAI’s asset monetisation.

- Launching Public InvITs: NHAI is considering launching a public InvIT to increase the overall investor base, increase retail participation in the infrastructure sector, develop a competitive environment in the InvIT market, and mitigate the risk of a limited investor base.

- Offering Multiple Bundle Sizes: NHAI already has initiatives underway to increase the number and volume of ToT bundles and InvIT phases by offering three ToT bundles per quarter and conducting one/two InvIT phases.

- Improving Risk-Reward Mechanism for Concessionaires: Creating mechanisms for hedging the risks of investors. For example model concession agreement for ToT, concessionaires are only expected to absorb the risk of traffic variation up to 5%.

- High Quality Institutional Investment: Targeted outreach programs across geographic locations and investor profiles to attract high-quality investors with expertise in the infrastructure sector.

- Periodic review of existing policies: Regular engagement with investors to understand investors’ concerns and revise the MCA/ bidding process.

- Developing an impactful ‘value proposition’ by producing compelling communication material that highlights socio-economic benefits such as improved connectivity, job creation & economic growth.

- Expand outreach base: networking at international conferences, business events, roadshows and seminars.

- Collaborate with financial intermediaries

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...