Table of Contents

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India’s economy, contributing significantly to employment and GDP. Within this vast ecosystem, women entrepreneurs are emerging as powerful change-makers. Despite systemic challenges, women-owned MSMEs are making notable contributions to economic growth, innovation, and social empowerment.

Women in MSMEs

Participation

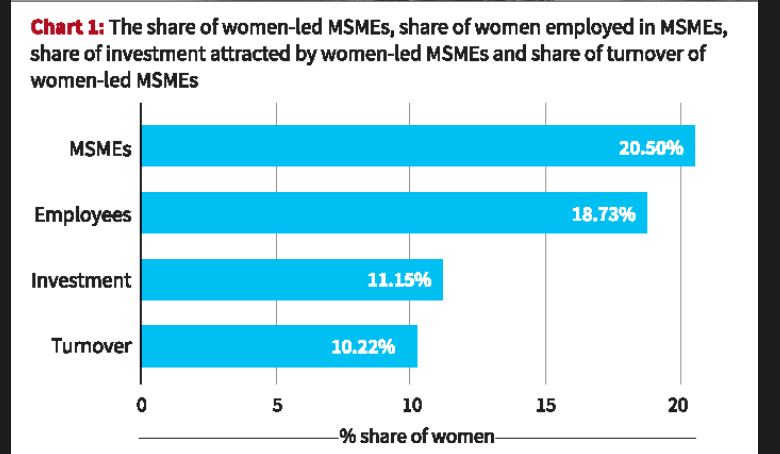

- Women-owned MSMEs: Around 20% of all MSMEs registered in India are women-owned.

- Contribution to total MSME turnover: ~10%

- Share in total MSME sector investment: 11–15%

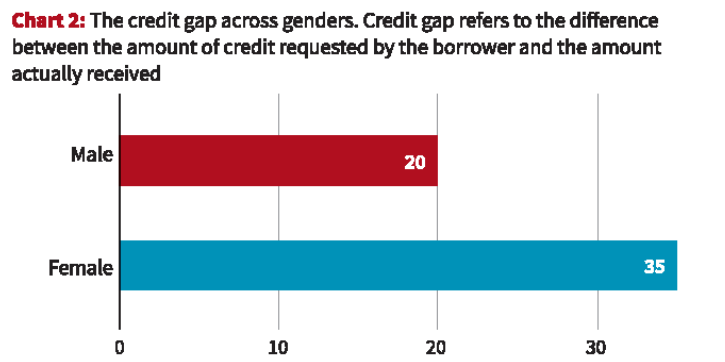

Access to Credit

- Credit Gap: Women-led MSMEs’ credit gap of about 35% (i.e., over a third of their financial needs are unmet).

- Men-led MSMEs: Credit gap of about 20%.

- Reasons:

- Low collateral/property ownership, financial illiteracy, and bias in lending.

- Women are often perceived as riskier borrowers by banks.

Government Schemes & Impact

PM MUDRA Yojana (PMMY)

The government’s flagship scheme for micro-enterprises, PMMY, is a key enabler for women entrepreneurs:

- Women account for approximately 64% of all PMMY loan accounts.

- However, these women-owned enterprises receive only about 41% of the total sanctioned loan amount, indicating room for better financial inclusion.

Udyam Assist Portal & Informal Micro Enterprises (IMEs)

- Over 86 crore Informal Micro Enterprises (IMEs) were registered through the Udyam Assist Portal in 2024.

- Women own a striking 70.5% of these registered IMEs.

- Women-led IMEs generate around 70.8% of employment within this segment, underscoring women’s critical role in grassroots job creation.

The Economic and Social Impact of Women-Led MSMEs

Women entrepreneurs in MSMEs not only contribute to economic growth but also drive:

- Inclusive development by empowering marginalized and rural women.

- Job creation especially for other women and youth.

- Innovation by introducing diverse perspectives in products and services.

- Improved family welfare as women reinvest income into health, education, and community development.

Opportunities and the Way Forward

To unlock the full potential of women in MSMEs, the following measures are crucial:

- Enhanced Access to Finance: Develop collateral-free loans, credit guarantee schemes, and women-focused financial products.

- Capacity Building: Offer targeted training, mentorship, and digital literacy programs for women entrepreneurs.

- Policy Reforms: Address systemic biases and encourage gender-sensitive lending practices in banks and NBFCs.

- Market Linkages: Create platforms to connect women-led MSMEs with buyers, export opportunities, and value chains.

Conclusion

Women-owned MSMEs are pivotal to India’s economic landscape, contributing significantly despite facing challenges such as a large credit gap and limited access to formal finance. With continued government support through schemes like PMMY and platforms like Udyam Assist, alongside focused policy reforms, women entrepreneurs are poised to reshape India’s MSME sector, driving sustainable and inclusive growth.

US–Israel Attack on Iran 2026: Khamene...

US–Israel Attack on Iran 2026: Khamene...

Agentic AI vs AI Agents: Meaning, Differ...

Agentic AI vs AI Agents: Meaning, Differ...

Prahaar Missile System: Range, Features ...

Prahaar Missile System: Range, Features ...