Key highlight of the Trends in Tax Collection

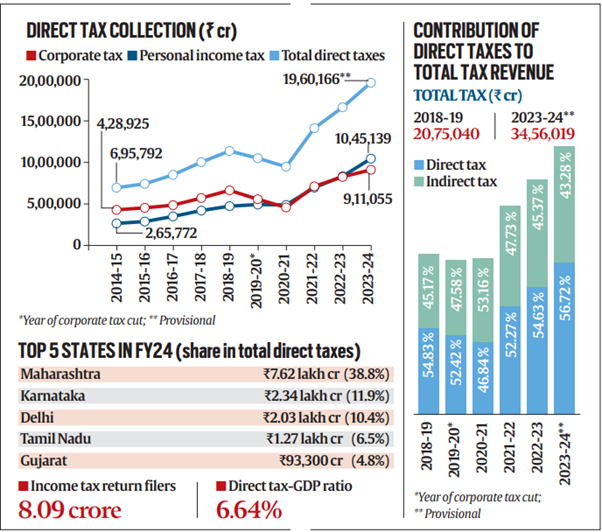

- In FY24, the contribution of direct taxes to total tax revenue reached 56.72%, the highest in 14 years.

- The direct tax-to-GDP ratio also hit a two-decade high of 6.64%.

- Personal income tax collections exceeded corporate tax collections for the second consecutive year.

- Tax buoyancy has increased to 2.12 in FY24, compared to 1.18 in FY23.

- The cost of tax collection dropped to 0.44% of total tax collections, the lowest since 2000-01.

| Related Terms |

| ● Direct Tax: It is a tax paid directly by the taxpayer to the government. In direct tax point of incidence and point of impact of a tax are the same.

○ E.g. Individual income tax, Corporate income tax, Capital gains tax etc. ○ Direct Taxes in India are administered by the Central Board of Direct Taxes (CBDT). ● Corporate Tax: It is a direct tax imposed by the government on the income or profits earned by a corporation. ● Tax Buoyancy Ratio: It is the ratio of change in tax revenue to the change in gross domestic product (GDP) of an economy. It measures how responsive a taxation policy is to growth in economic activities. ● Tax to GDP Ratio: It is an economic indicator that measures the proportion of a country’s total tax revenue relative to its Gross Domestic Product (GDP). ○ A higher ratio indicates the government is effectively collecting more direct taxes from its citizens. |

| UPSC PYQ |

Q. Consider the following statements: (2017)

Which of the statements given above is/are correct? (a) 1 only (b) 2 only (c) Both 1 and 2 (d) Neither 1 nor 2

Answer: D |

Israel Reopens Rafah Border with Egypt: ...

Israel Reopens Rafah Border with Egypt: ...

Next Phase for Rural Women Entrepreneurs...

Next Phase for Rural Women Entrepreneurs...

UPSC CSE 2026 New Rules: Complete Guide ...

UPSC CSE 2026 New Rules: Complete Guide ...