Table of Contents

Context: Sagarmala Finance Corporation Limited (SMFCL) has been established as India’s first maritime sector-specific Non-Banking Financial Company (NBFC).

What is Sagarmala Finance Corporation Limited (SMFCL)?

- Sagarmala Finance Corporation Limited (SMFCL) is a Mini Ratna Category-I Central Public Sector Enterprise (CPSE) under the Ministry of Ports, Shipping and Waterways (MoPSW).

- It operates as a specialised Non-Banking Financial Company (NBFC) focused solely on meeting the financial needs of India’s maritime sector.

- Headquarters: New Delhi.

Objectives

- Address financing gaps in maritime infrastructure and logistics.

- Promote financial inclusion for MSMEs, startups, and educational institutions within the sector.

- Support high-growth areas such as shipbuilding, cruise tourism, and green energy.

- Contribute to India’s ambition of global maritime leadership as outlined in the Amrit Kaal Vision 2047.

Functions

Provide short, medium-, and long-term credit facilities to port authorities, logistics firms, and maritime entrepreneurs.

- Fund innovative projects like green hydrogen initiatives, shipbuilding, and the digitalisation of ports.

- Act as a financial catalyst for Public-Private Partnership (PPP) projects in port and allied infrastructure.

- Collaborate with startups and research institutions to finance maritime skill development and R&D.

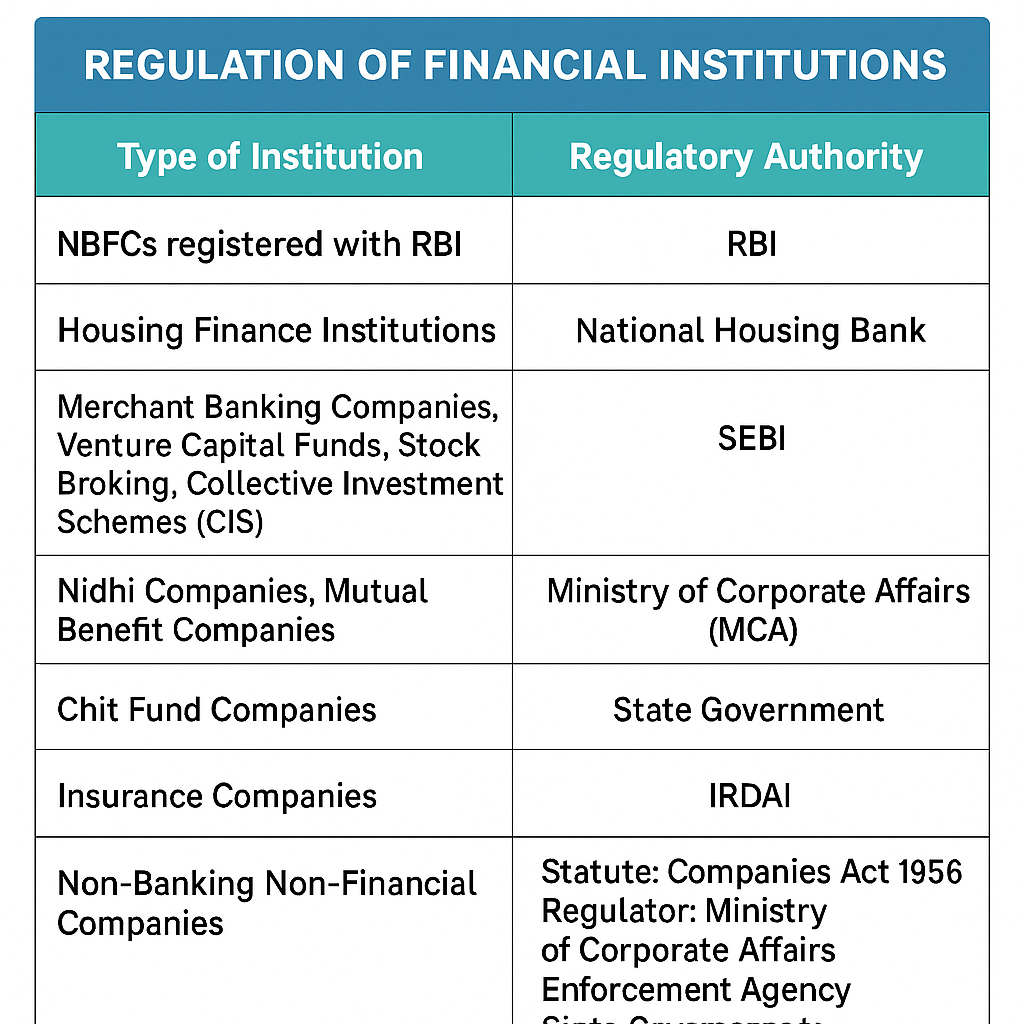

What Are NBFCs (Non Banking Financial Companies)?

- NBFCs are financial institutions that provide bank-like services but do not hold a banking license.

- They do not accept demand deposits (like savings accounts) but offer loans, asset financing, and investment services.

Types of NBFCs

- Based on Asset-Liability Structures: Deposit-taking NBFCs (NBFCs-D) and non-deposit-taking NBFCs (NBFCs-ND).

- Based on Systemic Importance: Among non-deposit taking NBFCs, those with an asset size of Rs 500 crore or more are classified as non-deposit taking systemically important NBFCs (NBFCs-ND-SI).

Difference between Banks & NBFCs

| Aspect | Bank | NBFC |

| Deposits | Accepts all types of deposits | Cannot accept demand deposits |

| Deposit insurance of DICGC | Applicable (up to Rs. 5 lakh) | Non-Applicable |

| Payment and Settlement System of the RBI | Supports RTGS, NEFT, etc. | Not supported. Cannot issue cheques. |

| Foreign investment (FDI) | Up to 74% | Up to 100% (Under Automatic Route) |

| Cash Reserve Requirement (CRR) | Applicable | Not Applicable |

| Capital Adequacy Norms | Applicable | Applicable only to Deposit-taking NBFCs and Systematically Important NBFCs (CRAR – 15%) |

| Statutory Liquidity Ratio (SLR) | Applicable | Applicable only to Deposit-taking NBFCs (SLR – 15%) |

| Established under | Banking Regulation Act, 1949 | Established under Companies Act and regulated by various bodies depending on category. |

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...