Table of Contents

Context: Regional Rural Banks (RRBs) have posted their highest-ever consolidated net profit of ₹7,571 crore in FY 2023-24.

About Regional Rural Banks (RRBs)

- Regional Rural Banks (RRBs) are aimed at providing banking services in rural areas, particularly to small farmers, artisans, rural entrepreneurs and weaker sections of society.

- Established under the Regional Rural Banks Act of 1976, on the recommendation of the Narasimham Committee on Rural Credit.

- Ownership structure: Central Government (50%), State Government (15%), and Sponsor Bank (35%).

- Regulation: Regulated by the Reserve Bank of India (RBI) and supervised by NABARD.

- First RRB of India – Pratham Grameen Bank. It was established on October 2, 1975.

- Priority Sector Lending (PSL)Target of RRB – 75%

Regional Rural Banks Functions

The functions of Regional Rural Banks (RRBs) can be summarized as follows:

| Regional Rural Banks Functions |

|

| Function | Details |

| Banking Services | RRBs provide banking services like savings accounts, current accounts, deposits, and basic transactions to rural areas. |

| Credit Facilities | RRBs offer loans to farmers, agricultural laborers, artisans, and small entrepreneurs for agriculture, livestock, machinery, housing, and small businesses. |

| Agricultural and Rural Development | RRBs support agricultural activities, rural infrastructure development, and small-scale industries for overall rural growth. |

| Financial Inclusion | RRBs promote financial inclusion by opening bank accounts, encouraging savings, and providing institutional credit to unbanked and underbanked rural areas. |

| Cooperative Banking Activities | RRBs work with agricultural cooperatives and self-help groups to provide financial support and foster cooperation among rural communities. |

| Priority Sector Lending | RRBs prioritize lending to sectors like agriculture, micro and small enterprises, and weaker sections of society as mandated by the RBI. The mandatory target for priority sector lending by RRBs is currently set at 75%. |

Achievements of Regional Rural Banks

- RRBs have played a crucial role in providing credit to the agricultural sector, which is vital for rural development. As of March 2021, RRBs had a total agricultural credit outstanding of over Rs. 2.4 lakh crore (approximately USD 32.7 billion).

- Also, RRBs have supported rural entrepreneurship and small businesses, contributing to employment generation in rural areas. According to the National Bank for Agriculture and Rural Development (NABARD), RRBs have created over 4 million jobs through their credit and support to small-scale industries.

- RRBs impact can also be gauged from the role they have played in promoting financial inclusion in rural areas. They have opened a significant number of accounts for previously unbanked individuals.

- According to the NABARD, RRBs have opened over 140 million accounts as of March 2021, providing banking services to previously underserved rural populations.

Challenges Faced by Regional Rural Banks

The challenges faced by RRBs can be summed as follows:

Financial Viability

Maintaining financial viability is a challenge for RRBs due to factors such as low profit margins, high operating costs, and loan recovery issues in rural areas.

Asset Quality

RRBs often face challenges in managing asset quality, especially in the agricultural sector where loan defaults can occur due to factors like crop failure, natural disasters, or price fluctuations.

Capital Constraints

RRBs may face capital constraints, limiting their ability to meet the increasing credit demand in rural areas and comply with regulatory requirements.

Technological Advancements

Adopting and integrating new technologies pose a challenge for RRBs, particularly in remote rural areas where infrastructure and connectivity are limited.

Human Resource Development

RRBs face challenges in attracting and retaining skilled personnel in rural areas, which can impact their ability to deliver efficient banking services and implement effective risk management practices.

Governance and Management

Effective governance and management practices are essential for the smooth functioning of RRBs. However, challenges related to governance, leadership, and internal controls may arise, impacting operational efficiency and transparency.

Reforms Needed in Regional Rural Banks

Several committees have been constituted to recommend reforms for Regional Rural Banks (RRBs). Here are recommendations of some notable committees:

Vyas Committee (2004)

- Recommended the conversion of RRBs into full-fledged commercial banks to enhance their financial strength and operational efficiency.

- Suggested raising the capital adequacy ratio to 9% to ensure the financial stability of RRBs.

- Advocated for the strengthening of governance and management practices in RRBs.

Chore Committee (2015)

- Recommended measures to improve the financial viability of RRBs, including capital infusion by the government and sponsorship by strong commercial banks.

- Emphasized the need for performance-based incentives and a robust business strategy for RRBs.

- Suggested the adoption of technology-driven banking practices and enhanced risk management frameworks.

Nayak Committee (2018)

- Recommended a comprehensive reform package for RRBs, including the recapitalization of financially weak RRBs.

- Suggested consolidation of RRBs to create stronger and more sustainable entities.

- Emphasized the importance of enhancing digital banking capabilities and financial inclusion efforts.

Sudarshan Sen Committee (2019)

- Recommended a roadmap for the transformation of RRBs into “Universal Banks for Rural India.“

- Advocated for the strengthening of governance, risk management, and internal controls in RRBs.

- Suggested the adoption of digital technologies and innovative banking practices to enhance operational efficiency and customer service.

Regional Rural Banks in India

The primary goal of the introduction of RRBs in India was to comfort those residing in rural areas by giving them access to all necessary banking resources and services. The list of regional rural banks in India is broken down by state, along with information about their sponsor banks and corporate headquarters:

| List of Regional Rural Banks in India | |||

| State | Name of RRB | Sponsor Bank | Head Office |

| Andhra Pradesh | Andhra Pragathi Grameena Bank | Syndicate Bank | Kadapa |

| Chaitanya Godavari Grameena Bank | Andhra Bank | Guntur | |

| Andhra Pradesh Grameena Vikas Bank | State Bank of India | Kadapa | |

| Saptagiri Grameena Bank | Indian Bank | Chittor | |

| Arunachal Pradesh | Arunachal Pradesh Rural Bank | State Bank of India | Naharlagun |

| Assam | Assam Gramin Vikash Bank | United Bank of India | Guwahati |

| Langpi Dehangi Rural Bank | State Bank of India | Diphu | |

| Bihar | Uttar Bihar Gramin Bank | Central Bank of India | Muzaffarpur |

| Bihar Gramin Bank | UCO Bank | Patna | |

| Madhya Bihar Gramin Bank | Punjab National Bank | Patna | |

| Chhattisgarh | Chhattisgarh Rajya Gramin Bank | State Bank of India | Raipur |

| Gujarat | Baroda Gujarat Gramin Bank | Bank of Baroda | Bharuch |

| Dena Gujarat Gramin Bank | Dena Bank | Gandhinagar | |

| Saurashtra Gramin Bank | State Bank of India | Rajkot | |

| Haryana | Sarva Haryana Gramin Bank | Punjab National Bank | Rohtak |

| Himachal Pradesh | Himachal Pradesh Gramin Bank | Punjab National Bank | Mandi |

| Jammu and Kashmir | Ellaquai Dehati Bank | State Bank of India | Srinagar |

| J&K Grameen Bank | J&K Bank Ltd. | Jammu | |

| Jharkhand | Vananchal Gramin Bank | State Bank of India | Ranchi |

| Jharkhand Gramin Bank | Bank of India | Ranchi | |

| Karnataka | Pragathi Krishna Gramin Bank | Canara Bank | Ballari |

| Kaveri Gramin Bank | State Bank of India | Mysuru | |

| Karnataka Vikas Grameena Bank | Syndicate Bank | Dharwad | |

| Kerala | Kerala Gramin Bank | Canara Bank | Mallapuram |

| Madhya Pradesh | Narmada Jhabua Gramin Bank | Bank of India | Indore |

| Central Madhya Pradesh Gramin Bank | Central Bank of India | Indore | |

| Madhyanchal Gramin Bank | State Bank of India | Sagar | |

| Maharashtra | Vidarbha Konkan Gramin Bank | Bank of India | Nagpur |

| Maharashtra Gramin Bank | Bank of Maharashtra | Aurangabad | |

| Manipur | Manipur Rural Bank | United Bank of India | Imphal |

| Meghalaya | Meghalaya Rural Bank | State Bank of India | Shillong |

| Mizoram | Mizoram Rural Bank | State Bank of India | Aizawl |

| Nagaland | Nagaland Rural Bank | State Bank of India | Kohima |

| Odisha | Odisha Gramya Bank | Indian Overseas Bank | Bhubaneshwar |

| Utkal Grameen Bank | State Bank of India | Bolangir | |

| Puducherry | Puduvai Bharathiar Grama Bank | Indian Bank | Puducherry |

| Punjab | Punjab Gramin Bank | Punjab National Bank | Kapurthala |

| Malwa Gramin Bank | State Bank of India | Sangrur | |

| Sutlej Gramin Bank | Bhatinda | ||

| Rajasthan | Baroda Rajasthan Kshetriya Gramin Bank | Bank of Baroda | Ajmer |

| Rajasthan Marudhara Gramin Bank | State Bank of India | Jodhpur | |

| Tamil Nadu | Pallavan Grama Bank | Indian Bank | Salem |

| Pandyan Grama Bank | Indian Overseas Bank | Virudhunagar | |

| Telangana | Telangana Grameena Bank | State Bank of India | Hyderabad |

| Tripura | Tripura Gramin Bank | United Bank of India | Agartala |

| Uttar Pradesh | Gramin Bank of Aryavart | Bank of India | Lucknow |

| Allahabad UP Gramin Bank | Allahabad Bank | Banda | |

| Baroda Uttar Pradesh Gramin Bank | Bank of Baroda | Raebareli | |

| Kashi Gomti Samyut Gramin Bank | Union Bank of India | Varanasi | |

| Sarva UP Gramin Bank | Punjab National Bank | Meerut | |

| Prathama UP Gramin Bank | Syndicate Bank | Moradabad | |

| Purvanchal Bank | State Bank of India | Gorakhpur | |

| Uttarakhand | Uttarakhand Gramin Bank | State Bank of India | Dehradun |

| West Bengal | Bangiya Gramin Vikash Bank | United Bank of India | Murshidabad |

| Paschim Banga Gramin Bank | UCO Bank | Howrah | |

| Uttarbanga Kshetriya Gramin Bank | Central Bank of India | Coochbehar | |

Candidates who wish to submit an online application for the forthcoming IBPS RRB recruitment can do so using the list of regional rural banks that is provided above. The state from which a candidate wishes to apply for the exam is a choice.

Difference between RRBs & Commercial Banks

Major distinctions between regional rural banks and commercial banks are mentioned below in terms of their goals, areas of focus, stakeholder participation, etc.

| Difference between RRBs & Commercial Banks |

||

| RRB | Points of Difference | Commercial Banks |

| Development of individuals in the rural and backward areas by way of providing credit and banking facilities. | Purpose | Earn profits out of deposits, loan extending, and other activities. |

| Limited to agriculture finance, small sector loans, craftsmen, artisans, and other small sectors. | Scope | They not only provide agriculture finance but also offer loans for housing, vehicles, letters of credit, etc. |

| Present in rural and semi-urban areas only | Area of operation | Present all over the country including rural, semi-urban, and urban. |

| Accepting deposits and granting loans to needy individuals in rural and semi-urban areas. | Focus | Apart from lending and borrowing, these banks also carry out stock broking, merchant banking, venture capital financing, asset management, etc. |

| Stakeholders include the government of India, the state government, and commercial banks as sponsors. | Stakeholding | Stakeholders are the public, central government, etc. |

| Related Articles | |

| Types of Banks in India | List of RBI Governors of India |

| Indian Financial System | Public Sector Banks |

| Banking System in India | |

What is Visible and Invisible Trade with...

What is Visible and Invisible Trade with...

Chemical Industry in India: Powering Ind...

Chemical Industry in India: Powering Ind...

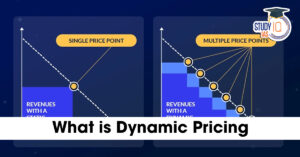

Dynamic Pricing: What It Is and Why It's...

Dynamic Pricing: What It Is and Why It's...