Table of Contents

Context: India’s GST has seen its biggest revamp since 2017, aimed at easing consumer costs, boosting demand, and giving a festive-season growth push – though it also raises concerns about revenue loss and fiscal sustainability.

In a revolutionary step that represents one of the biggest reworks in eight years, Finance Minister Nirmala Sitharaman announced the Next-Gen GST Reforms at the 56th GST Council meeting on 3 September 2025. These reforms are set to rationalise India’s round-the-year indirect tax structure, ease compliance, and bring much-needed relief to consumers and businesses alike by trimming the present four-rate GST regime into two basic slabs.

FM Nirmala Sitharaman Announced New GST Rates

In a major redesign of India’s oblique taxation regime, Finance Minister Nirmala Sitharaman made sweeping Goods and Services Tax (GST) rate reductions, starting from September 22, 2025. The GST Council has cleared a new two-tier structure of 5% and 18%, replacing the earlier four tiers. A new 40% “special rate” has also been added to sin items and luxury goods.

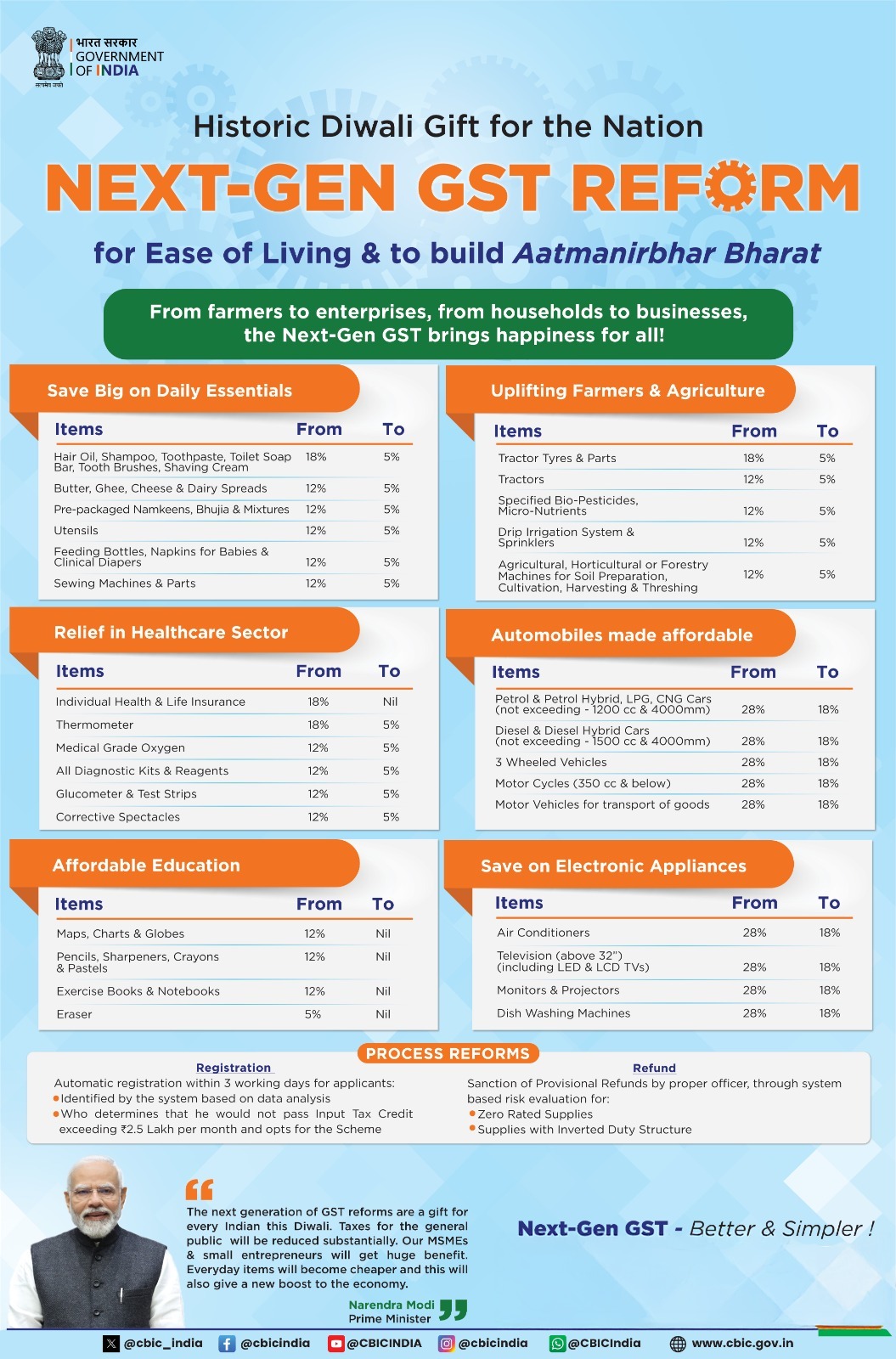

These changes are aimed to gain the benefit of the general consumer and enhancing domestic consumption. Most common household commodities, such as hair oil, soap, shampoo, and kitchen utensils, have had their GST rate cut down from 18% or 12% to a new 5% slab. Basic foodstuffs like UHT milk, paneer, and Indian breads like chapati and roti will have a nil GST rate, making them fully tax-free.

Effective Date for GST 2.0 Plan

These reforms under the “GST 2.0” plan will come into force from 22 September 2025, during the Navratri festival, except for a few sin goods which will be phased in later.

The government expects the combined revenue loss to be around ₹48,000 crore. Experts put it lower at reduced inflationary pressure and increased consumption, with the potential for a rise of 0.5 percentage points in GDP growth.

Next Gen GST Reforms: Two-Tier Tax Structure

The GST Council has voted unanimously in favour of a streamlined tax system consisting:

- 5% slab: Aims at mass consumer items—kitchen basics, food, and cosmetics.

- 18% slab: Encompasses a broad range of products, including appliances and cars.

- 40% “sin/luxury” rate: Assesses luxury items and harmful products like high-value cars, tobacco products, and soft drinks.

This redesign abolishes the earlier 12% and 28% slabs completely.

New GST Rates List 2025

- Essentials now more Affordable (5%): Hair oil, soaps, shampoo, toothpaste, bikes, namkeen, pasta, chocolates, coffee, butter, ghee, cereals, and paneer (now nil GST)

- Relief in Healthcare: 33 lifesaving medicines exempted; other crucial medicines from 5% to nil

- Insurance Advantage: All individual life and health insurance policies are now GST-free.

- Automobiles and appliances: Small vehicles & motorbikes (≤350cc) brought down to 18%; EVs are kept at 5%; TVs, ACs, and home appliances at 18% tax

- Construction Materials: The proportion of cement decreases from 28% to 18%.

The Next-Gen GST reforms by FM Nirmala Sitharaman usher in a revolutionary change in India’s indirect tax environment—powered by ease, consumer benefit, and economic strength. By easing the tax burden on everyday items and regularising the framework, the action demonstrates India’s commitment to promoting inclusive growth in a rapidly changing global context and strengthening local economic foundations.

Why was an GST Reforms Needed?

- Complex Structure: Earlier, GST had multiple slabs – 0%, 5%, 12%, 18%, 28% – plus a compensation cess. This created confusion, compliance burden, and frequent disputes.

- End of Compensation Cess: The legal provision for levying the cess (used to compensate states for revenue loss) is ending in 2025. Without rationalisation, some “sin goods” like tobacco would have suddenly become politically and socially unacceptable.

- Boosting Consumption: With the U.S. imposing 50% tariffs on Indian exports, India needed to boost domestic demand to offset external shocks.

- Stimulating Consumption: With Q1 GDP growth at 8%, the government wants to sustain momentum and avoid a slowdown in later quarters.

- Lower taxes mean cheaper goods, which can stimulate consumer spending.

- Next-Generation Reform Push: Simplifying GST was a long-standing demand of industries and states.

| Major Changes in GST Structure |

Sectors That Benefit

Sectors with Concerns

|

Economic Impact of the GST Overhaul

Short-Term Impact

- Boost to Consumption: Lower GST on everyday goods →means lower retail prices. With more disposable income, households can spend on other goods and services, creating a multiplier effect on demand.

- Inflation Moderation: Lower GST on essentials like food, medical items, and construction materials could soften inflationary pressures.

- Disruption in Some Sectors:

- Airlines fear that higher GST on non-economy seats will raise fares and hurt demand.

- Auto dealers worry consumers will delay purchases until new rates apply (Sept 22 onwards).

Medium-Term Impact

- Virtuous Investment Cycle: More consumer demand → industries expand production → more jobs created → higher household incomes → more demand again.

- Eg: Cheaper cement reduces construction costs → housing demand rises → jobs in real estate and allied industries → more income and spending.

- Support to Growth Amid External Pressures: With the U.S. imposing a 50% tariff on Indian imports, exports may suffer. Domestic consumption, supported by lower GST, can cushion India’s GDP growth from global shocks.

- Push for Green Economy: Lower GST on renewable energy components accelerates the clean energy transition, aligning economic growth with sustainability goals.

Long-Term Impact

- Formalisation of Economy: Simplified GST slabs reduce compliance burden for MSMEs, bringing more small firms into the formal tax net.

- Attracting Investment: A simpler and more predictable GST system improves India’s Ease of Doing Business

- Fiscal Challenges for Union & State Government: States’ concerns about compensation could strain Centre-State relations, unless a new framework for revenue-sharing is developed.

- Centre’s Estimate: Revenue shortfall of ₹48,000 crore.

- States’ Worry: They may bear 70% of the shortfall; demand for a cess on the 40% slab is not accepted.

- Structural Reform Direction: Over time, India may move to just 2–3 GST slabs, like other mature economies. This could simplify tax administration, cut compliance costs, and create a more efficient, growth-oriented tax system.

What More Needs to Be Done?

- Ensure Revenue Neutrality: Protect States’ fiscal health. Explore formula-based transfers or temporary revenue-sharing adjustments.

- Address Inverted Duty Structures: Still unresolved in vegetable oils, textiles (partly), and MSMEs.

- Strengthen Compliance & Broaden Base: Use of digital tools (AI-driven audits, e-invoicing, GSTN data analytics) to curb evasion.

- Expand Formalisation: Encourage MSMEs and informal sectors to join the GST net with simplified procedures.

- Integrate with Climate Goals: Use GST incentives (lower slabs) for green goods and EVs, higher slabs for polluting industries.

India’s GST 2.0 reform marks a bold leap toward a fairer, simpler tax system. It promises to drive consumption, support economic resilience, and move India toward global tax norms. But the government will need to manage revenue losses and state-level fiscal pressures carefully to ensure sustainability.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...