Context: India reduced the 15% import duty for Electric Vehicles (EV) to attract manufacturers like Tesla.

New Electric Vehicle Policy

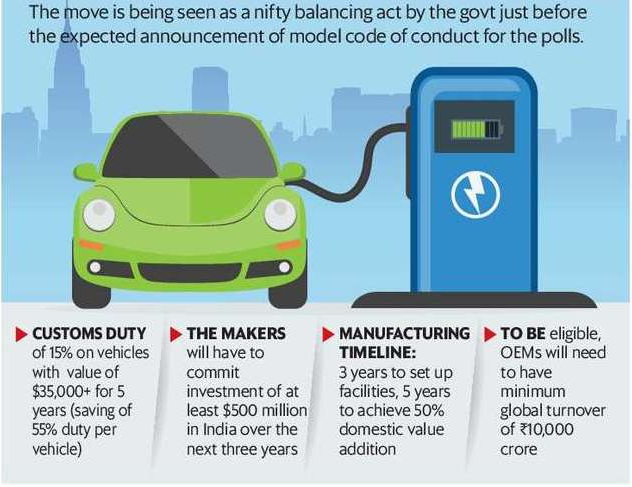

- Import Duty Reduction: The Indian government has slashed the import duties for electric vehicles (EVs) that are imported as completely built units (CBUs) to 15%, down from the existing range of 70% to 100%.

- Objective: To expand the electric vehicle market in India by attracting new players and introducing advanced EV technology to the country.

- It is not intended to undercut the existing market but to complement and enhance it by fostering technological growth and broadening consumer choice.

- Manufacturing Incentive: This reduction in import duties is contingent upon the EV manufacturer committing to set up a local manufacturing unit in India within three years of availing the duty reduction.

- Investment and Production: Automakers are required to invest a minimum of ₹4,150 crore (or around $500 million), begin manufacturing locally within three years, and achieve at least 25% domestic value addition within that time frame.

- Limitation: The concessional duty rate applies only to EVs that are priced at $35,000 or more, which includes cost, insurance, and freight charges.

- There is a limitation on the number of vehicles that can be imported at the reduced duty, capped at 8,000 vehicles per year.

- Policy Duration: The duty relief is valid for five years.

We’re now on WhatsApp. Click to Join

Graphic Processing Units (GPUs) – Work...

Graphic Processing Units (GPUs) – Work...

Gold Imports and the Indian Economy – ...

Gold Imports and the Indian Economy – ...

Nilgiri Tahr Conservation: Ecology, Habi...

Nilgiri Tahr Conservation: Ecology, Habi...