Table of Contents

Context: A report by the Reserve Bank of India (RBI) on municipal finances highlighted the rise in tax revenue share in recent years.

- Theme: “Own Sources of Revenue Generation in Municipal Corporations: Opportunities and Challenges.”

- The first edition was published two years ago.

Revenue Generation Breakdown

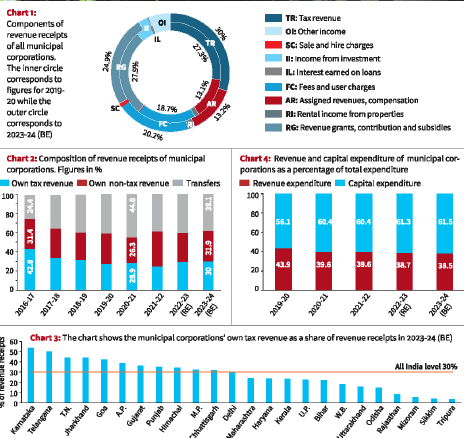

In FY24, municipal corporations are projected to generate their revenue from various sources:

- Own Taxes, Fees, and User Charges: 50%

- Revenue Grants from Central and State Governments: 25%

- Other Sources: The remaining portion includes rental income, compensations, and investment income.

| Sources of Revenue of Municipal Corporation in India |

|

Short-Term Revenue Comparison (FY24 vs. FY20)

- Own Tax Revenue: Increased from 27.3% to 30%

- Fees and User Charges: Rose from 18.7% to 20.2%

- Revenue Grants, Contributions, and Subsidies: Decreased from 27.9% to 24.9%

- Compensations and Rental Income: Remained stable at 13% and 6%, respectively.

- Interest and Investment Income: Constituted about 1-2% of total revenue in both periods.

This data indicates a growing ability of municipal corporations to raise their own revenue while decreasing reliance on government grants.

Long-Term Revenue Comparison (FY24 vs. FY17)

- In FY17, own tax revenue constituted 43% of total revenue; this has significantly dropped to only 30% in FY24.

- Conversely, the share of transfers from Central and State governments has increased, indicating a long-term decline in self-generated revenue capabilities post-GST.

State-wise Own Tax Revenue

- In FY24, the highest own tax revenue generation was reported in:

- Karnataka: 53.8%

- Telangana: 50.3%

- Tamil Nadu: 44.3%

- Jharkhand: 44.0%

- States such as Rajasthan, Odisha, and Uttarakhand reported the lowest ratios.

Expenditure Quality Improvement

The quality of expenditure among municipal corporations is showing improvement:

- The share of revenue expenditure decreased from 43.9% in 2019-20 to 38.5% in 2023-24 (BE).

- Correspondingly, capital expenditure increased from 56.1% to 61.5%, indicating a shift towards more productive spending.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...