Table of Contents

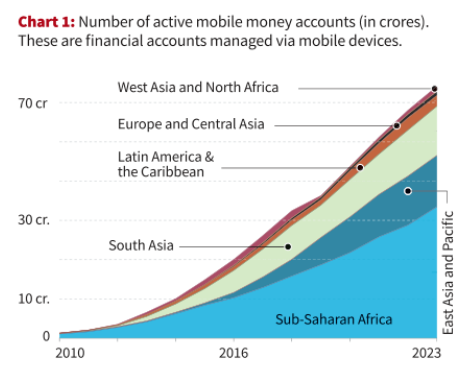

Context: A new report reveals that over half a billion mobile money accounts now exist globally, with most of them in Africa, where mobile money is rapidly transforming financial inclusion, especially for people without access to traditional banking.

About Mobile Money

- Mobile money allows people to send, receive, deposit, and withdraw money using text messages on basic mobile phones.

- Unlike standard banking, it doesn’t require a physical bank branch or an internet connection.

- It’s especially useful in regions with limited access to formal banking, such as Sub-Saharan Africa.

Global Adoption Trends of Mobile Money

The number of active mobile money accounts has surged, with Sub-Saharan Africa leading globally

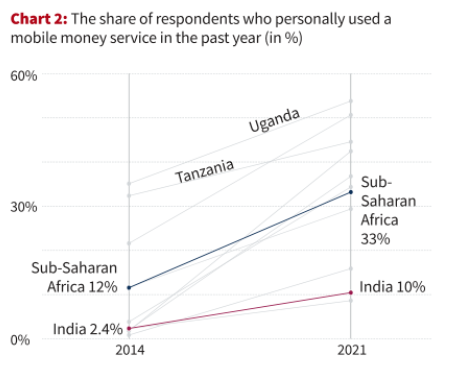

In Sub-Saharan Africa, the share of people with a mobile money account rose from 12% (2014) to 33% (2021) (Chart 2). Countries like Uganda, Tanzania, and Kenya have some of the highest usage rates.

Impact of Mobile Money on Financial Inclusion

- In 2014, only one-third of adults in Sub-Saharan Africa had a bank account; by 2021, that number more than doubled.

- A major part of this increase is due to mobile money.

- Many users only have a mobile money account, not a traditional bank account.

Key Data Insights

- In countries like Malawi, Cameroon, and Togo, mobile money has become a major contributor to financial account ownership.

- In Sub-Saharan Africa, mobile money usage correlates strongly with mobile phone ownership.

Mobile money is revolutionizing financial access, particularly in Africa, by offering safe, low-cost, and accessible financial services to unbanked populations, without the need for traditional banking infrastructure.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...