Table of Contents

Context: For years, the government and regulators have attempted incremental reform in banking, financial services, and insurance (BFSI), yet systemic frictions persist.

Reforms Introduced by the Government and Regulators in the BFSI Sector

Unified KYC and UBO Norms

India, as a member of the Financial Action Task Force (FATF), is implementing global KYC norms.

- The Securities and Exchange Board of India (SEBI) has started pressing foreign portfolio investors (like Elara and Vespera Funds) to disclose granular shareholder and UBO (Ultimate Beneficial Ownership) data.

- This aims to increase transparency and prevent misuse of complex ownership structures via tax havens like Mauritius.

Retirement Planning Reforms

The government and the RBI have enabled the issuance of long-dated sovereign bonds.

- There is an ongoing push for zero-coupon government securities to replace costly annuity products in retirement planning.

- This removes the 2% intermediation margin taken by insurance companies, benefiting savers in the long run.

Digital Infrastructure and Tech Integration

The government has promoted platforms like:

- Account Aggregator (AA) framework – allows individuals to access and share financial data securely.

- Central KYC (CKYC) registry – simplifies KYC for customers across financial institutions.

- These platforms promote financial inclusion, interoperability, and ease of doing finance.

Corporate Bond Market Initiatives

The RBI had mandated the National Stock Exchange (NSE) to develop a secondary bond market to improve liquidity and transparency.

Challenges in India’s Financial Sector Reforms

Fragmented Nomination Framework Across BFSI

- Across banking, mutual funds, and insurance, nomination rules vary widely — for example, the single nominee is allowed in some instruments and multiple in others, with differing legal rights.

- This lack of consistency leads to confusion among ordinary savers and often results in litigation due to legal ambiguities.

Shallow and Opaque Corporate Bond Market

Despite several policy pronouncements, India’s corporate bond market remains underdeveloped, with limited liquidity and transparency.

- The cost of capital remains high; a deeper bond market could reduce funding costs by 2–3%, significantly benefiting industries.

- RBI once mandated the development of a secondary bond market was not effectively implemented.

Inadequate Disclosure of Ultimate Beneficial Owners (UBOs)

Current UBO thresholds — 10% for companies and 15% for partnerships — allow entities to stay just below the radar, avoiding full disclosure.

- This loophole hampers regulatory oversight, especially when foreign portfolio investments are routed via opaque jurisdictions like Mauritius.

- For instance, Elara India Opportunities Fund and Vespera Fund resisted SEBI’s repeated requests to disclose granular shareholder data, delaying regulatory action.

Expensive and Inefficient Retirement Planning Instruments

Retirement plans are largely annuity-based, which are costly due to a 2% intermediation margin charged by insurance firms.

- Over 30 years, this eats into significant returns for savers.

- Cheaper options like long-dated zero-coupon government securities are available but not promoted by the government or the RBI.

Unchecked Rise of Shadow Banking

Non-Banking Financial Companies (NBFCs), brokers, and repo traders now provide bank-like services with limited regulatory scrutiny.

- Brokers finance retail investors through margin loans disguised as investments, often at interest rates exceeding 20%, without clear disclosures.

- There is little to no data on the scale of these shadow banking operations, making systemic risk assessment difficult.

Reforms Required in India’s Financial Sector

Unified and Transparent Nomination System

- Introduce a harmonised nomination regime across all BFSI sectors with clear definitions of nominee rights versus legal heir claims.

- If divergence exists, the government should provide a rationale supported by data and case studies.

Revamp and Deepen the Corporate Bond Market

- Enforce the RBI’s earlier mandate to the NSE to develop an active secondary bond market.

- Improve transparency, reduce trading opacity (e.g., curb algorithmic manipulations), and create incentives for greater issuer and investor participation.

Strengthen Ownership Disclosure Norms

- Revise UBO thresholds to close evasion gaps and ensure full disclosure of economic interest, in line with FATF’s 2022 guidelines.

- Mandate accurate, accessible, and up-to-date ownership records to improve capital market integrity and investor confidence.

Promote Low-Cost Retirement Options Based on Sovereign Bonds

- Strip principal and coupon components from government securities to create zero-coupon bonds suitable for long-term retirement savings.

- Remove the 2% insurance intermediation layer to deliver higher net returns to savers.

Regulate and Monitor Shadow Banking Activities

Conduct comprehensive data collection on activities of NBFCs, brokers, and margin lenders.

- Follow the European Union’s model of first gathering data to assess risks and then regulating based on evidence.

- Ensure transparency precedes regulation to avoid unintended market disruptions.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

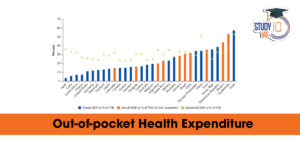

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...