Table of Contents

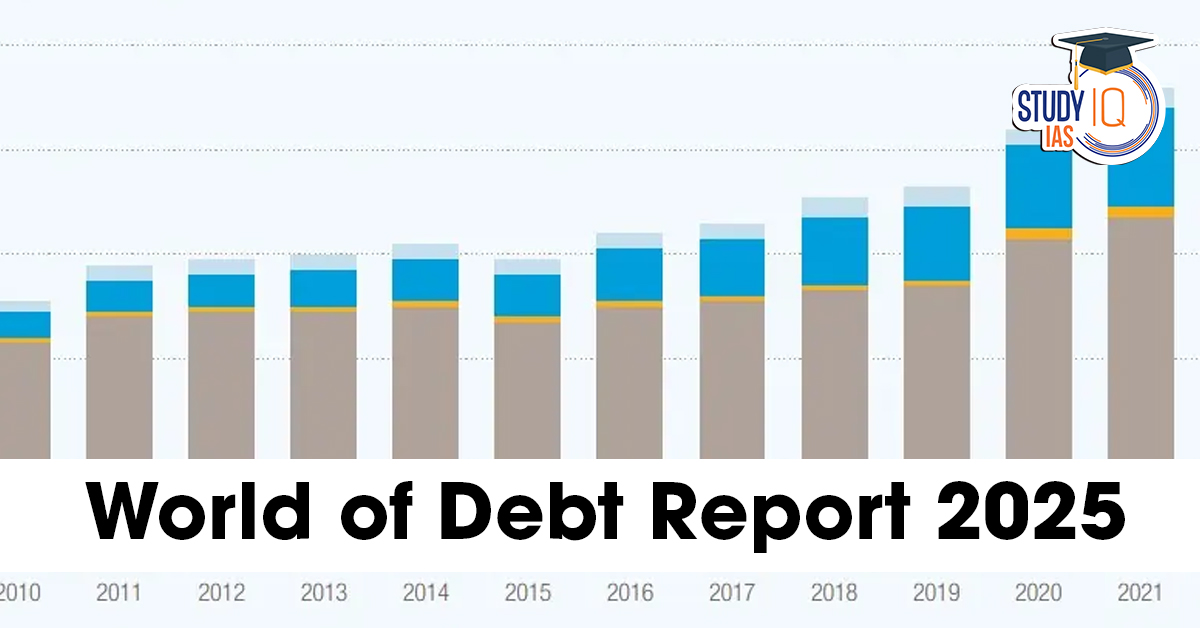

Context: Recently, the World of Debt Report 2025 was released by the United Nations Conference on Trade and Development (UNCTAD).

Key Highlights from UNCTAD’s A World of Debt Report 2025

- Global debt reaches record high: Total public debt surged to US $102 trillion in 2024, up from US $97 trillion in 2023.

- Developing nations disproportionately burdened: Low- and middle-income countries now hold US $31 trillion, nearly one-third of global debt, and their debt has doubled in growth rate compared to advanced economies since 2010.

- Sky-high interest payments crowd out development: Developing countries paid a record US $921 billion in net interest in 2024—a 10% increase year-over-year.

- A total of 61 countries spent over 10% of their government revenue just servicing interest.

- Debt servicing exceeds social spending: Approximately 4 billion people live in countries that spend more on interest payments than on health or education.

Urgent International Financial Reforms Needed

UNCTAD urges a comprehensive reform agenda to address the crisis:

- Strengthen the global financial architecture to be more inclusive and development-focused.

- Improve liquidity mechanisms in crises.

- Establish robust debt workout processes.

- Expand concessional finance and technical assistance for debt management

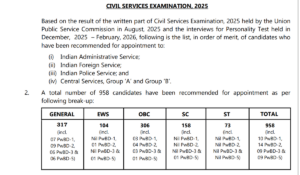

Athira Sugathan: Kerala Woman Who Cleare...

Athira Sugathan: Kerala Woman Who Cleare...

UPSC Reserve List 2025: Meaning, Categor...

UPSC Reserve List 2025: Meaning, Categor...

UPSC Final Result 2025 OUT: Anuj Agnihot...

UPSC Final Result 2025 OUT: Anuj Agnihot...