Table of Contents

Context: Recently the US dollar has started losing value due to reciprocal tariffs.

What is the Bond Market?

- Bond = A Loan to Government or Company

- When a government or company needs money, they borrow from investors by issuing “bonds”.

- A bond is a promise to repay the money after a fixed time, with regular interest payments.

- Government Bonds = Very Safe Investments

- Bonds issued by governments (like UK, US, India) are considered low-risk, because governments rarely default.

- These are often called “sovereign bonds”.

- Bond Price and Yield

- Bond Price: The cost of buying the bond in the market.

- Yield: The return you get (like interest) from the bond.

- If bond prices go down, yields go up, and vice versa.

Relation Between Bond Market and Currency Value

- Rising Yields = Investors Demand Higher Returns

- If investors think a country’s economic policy is risky (like too much borrowing), they sell that country’s bonds.

- This pushes bond prices down and yields up.

- Higher Yields = Higher Cost for the Government

- The government has to pay more interest to borrow money in the future.

- This can hurt government finances and investor confidence.

- Investor Confidence Affects Currency Value

- If investors lose trust in a country’s economy, they may also lose trust in its currency.

- They start selling the currency and pull out their money.

- Selling of Currency = Currency Weakens

- If many investors sell a currency (like the pound), its value falls compared to other currencies (like the US dollar).

- Example: UK Under Liz Truss (2022)

- Investors feared her tax-cut + spending plans would worsen debt and inflation.

- They sold UK bonds → yields rose → lost faith in the pound → pound crashed to a 37-year low.

Why Confidence in US Dollar Falling?

- Investor Uncertainty due to Unpredictable Tariff Policies: President Trump’s tariff-heavy approach — especially against allies and adversaries alike — created global uncertainty.

- Lack of clarity on end goals and arbitrary tariff rates spooked global markets, leading investors to diversify away from the US dollar.

- Rising US Government Bond Yields: Investors sold US government bonds, causing bond prices to fall and yields to rise.

- High yields typically attract investors, but in this case, rising yields were interpreted as a sign of increased risk and poor fiscal management (especially with national debt exceeding $35 trillion).

- Result: Investors demanded higher returns, signaling lower trust in long-term US financial stability.

- Shift to Other Stable Currencies: With rising global volatility, investors traditionally prefer to the US dollar. However, during this phase, they preferred the euro, yen, Swiss franc, etc.

- This shift shows a loss of faith in the dollar as a “safe haven”, a title it held for decades.

- Falling Oil Prices & Energy Market Woes: Trump’s policy of energy dominance (“drill baby drill”) was hit by slumping crude oil prices.

- Below $60/barrel, US shale oil becomes uneconomic, threatening one of the key pillars of US trade power.

- This undermined investor confidence in the US energy-backed economic narrative.

- Huge US Debt Burden: With $35 trillion+ in national debt, rising yields mean the US has to pay more in interest.

- This raises concerns about long-term debt sustainability, pushing investors away from US assets and reducing dollar demand.

- Political Interference & Policy Instability: The Federal Reserve’s independence has been a key reason behind global trust in the dollar.

- Any signs (even indirect) of political interference in monetary policy (as feared under Trump) undermines investor faith in the system’s credibility.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

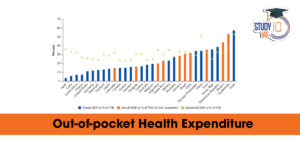

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...