Table of Contents

Context

- The Reserve Bank of India (RBI) has effectively managed consumer price inflation within its mandated range of 4% ± 2%.

- Strategic use of monetary policy has stabilised prices and protected consumer purchasing power.

Ensuring Financial Stability and Surplus Generation

- Financial Stability: The RBI has maintained overall financial stability in the country.

- Financial Surpluses: Prudent financial management has resulted in unprecedented financial surpluses.

- Transferred ₹2.11 trillion to the central government, bolstering fiscal resources for development projects and welfare schemes.

Collaboration with the Government for Economic Growth

- Cooperation: Close cooperation between the RBI and the Ministry of Finance has driven India’s GDP growth above 7%.

- Coordinated Policies: Monetary and fiscal policies are well-coordinated to achieve high growth while controlling inflation.

- Economic Environment: RBI’s monetary interventions and the government’s fiscal measures create a conducive environment for sustained economic expansion.

Addressing Food Inflation through Trade Policies

- Despite RBI’s efforts, food prices for essentials like wheat, rice, and pulses remain high.

- Government has implemented export controls on agricultural products to stabilise prices.

- Measures beneficial for consumers can limit farmers’ market access and revenue potential.

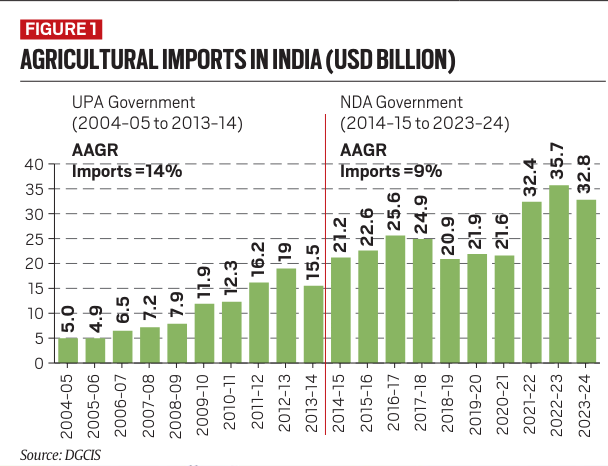

Decline in Agricultural Imports

- Import Reduction: Agricultural imports declined by 8% in 2023-24, falling to $32.8 billion from $35.7 billion in 2022-23.

- Edible Oils: Significant decrease in the import value of edible oils due to lower global prices, especially palm oil.

- Stable quantity of edible oil imports indicates a shift towards cost-effective procurement.

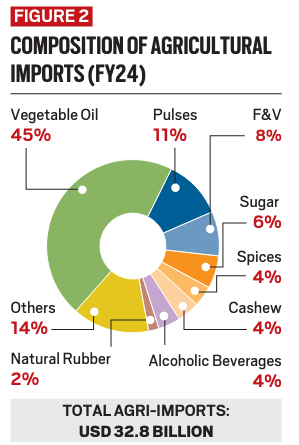

- Pulses and Edible Oil Import Dynamics:

- Pulses: Import value of pulses doubled in 2023-24 due to domestic production shortfalls and rising prices.

- Edible Oils: Fluctuating global prices directly impact India’s import expenses.

- Government liberalised pulses imports at zero duty to control domestic prices, risking farmers’ incomes.

Integrating Trade and MSP Policies

- Rational Trade Policy: Trade policy should align with Minimum Support Price (MSP) policy to protect farmers and ensure consumer affordability.

- Calibrated Approach: Avoid abrupt import duty changes to balance market dynamics.

- Ensure landed prices of imports do not undercut domestic MSPs.

- Support Mechanisms: Large-scale procurement by agencies like NAFED can support price stability and build buffer stocks.

- Promoting Self-Reliance in Edible Oils: Achieving self-sufficiency in edible oils by promoting palm oil cultivation.

- Expand palm oil cultivation on suitable lands for higher yield compared to traditional oilseeds.

- Integrate efforts with sustainable agricultural practices to balance economic and environmental objectives.

Conclusion

- Policy Integration: Integrate trade policies with MSP policies for sustainable agricultural development.

- Balance Interests: Balance protecting farmers’ interests with ensuring affordable consumer prices.

- Food Security and Stability: Promote self-reliance in pulses and edible oils to enhance food security and economic stability.

- Support Farmers: Support farmers while aligning with environmental goals for balanced economic growth and ecological sustainability.

Graphic Processing Units (GPUs) – Work...

Graphic Processing Units (GPUs) – Work...

Gold Imports and the Indian Economy – ...

Gold Imports and the Indian Economy – ...

Nilgiri Tahr Conservation: Ecology, Habi...

Nilgiri Tahr Conservation: Ecology, Habi...