Table of Contents

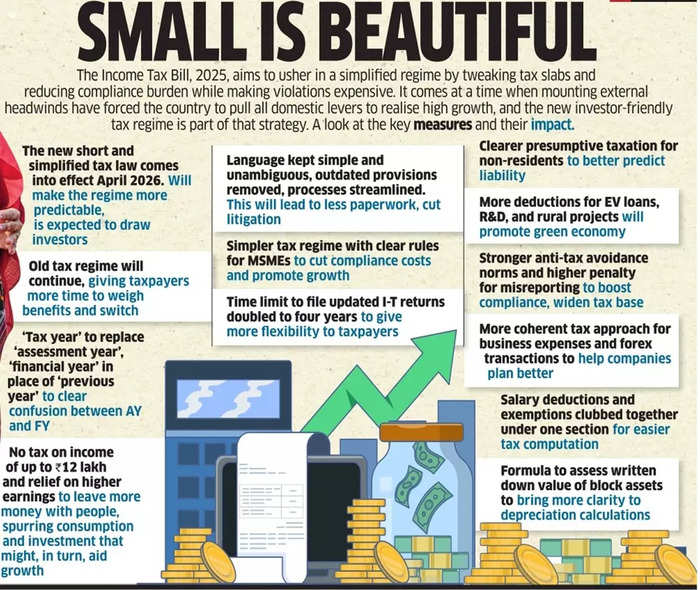

The Central government has formally withdrawn the Income Tax Bill, 2025, that was tabled to replace the six-decade-old Income Tax Act, 1961. A fresh, revised bill was tabled in the Lok Sabha on Monday, August 11, 2025. The original bill was withdrawn by Finance Minister Nirmala Sitharaman in order to include ideas and recommendations from all sources, such as a parliamentary select committee. The government aims to submit a single, unified draft to prevent ambiguity from having different versions and to keep the legislative language correct. Lok Sabha has passed the revised Income Tax Bill 2025.

Income Tax Bill 2025 Changes: Updated Key Provisions

- Replaces and shortens the existing Income Tax Act, 1961 (2.59 lakh words vs. 5.12 lakh words).

- Reduces chapters from 47 to 23 and sections from 819 to 536.

- Empowers officials to forcibly access personal emails and social media accounts of assesses during searches.

- Allows authorised officers to demand access codes for books, documents, or data in electronic form.

- Permits overriding of access codes to any computer system if codes are not provided.

- Covers all types of personal digital data, including passwords, chats, and messages.

- Justified as necessary for retrieving incriminating evidence from electronic devices.

- Criticised for potential misuse, privacy violations, and excessive powers of authorities.

Income Tax Bill 2025 Withdrawn by the Centre

| Aspect | Details |

|---|---|

| Withdrawal Date | August 8, 2025 |

| Original Bill Introduced | February 13, 2025 |

| Reason for Withdrawal | Incorporate Select Committee suggestions; correct drafting errors |

| Select Committee | 31 members, chaired by Baijayant Panda; submitted ~280+ suggestions |

| Key Clauses Targeted | Clauses 19–22 affecting property and salary deductions, and Clause 20 |

| New Bill Introduction | August 11, 2025 |

| Objectives of the New Bill | Simplification (~50%), taxpayer relief, clarity, and reduction in disputes |

| Special Focus | Ease for MSMEs, middle-class, anonym. donation rules, digital administration |

On August 8, 2025, the Union government tabled the Income-Tax Bill, 2025, which was previously submitted to the Lok Sabha on February 13 to replace the current Income-Tax Act, 1961. The withdrawal comes due to the necessity of including heavy feedback—more than 280 suggestions—by the Select Committee led by BJP MP Baijayant Panda

New Income Tax Bill 2025 in Parliament: Background

The New Income Tax Bill 2025 was introduced sometime between 11 am and 3:30 pm. The bill will be presented as part of the Legislative Business in Parliament. It is scheduled as the 27th item on the revised agenda for the Lok Sabha. The Income Tax Act of 1961 has changed 66 Budgets, including two interim budgets, since it was established.

The New Income Tax Bill 2025 revised regulations about cryptocurrency and digital transactions, but did not impose new taxes. The administration is expected to present the Waqf and New Immigration bills in Parliament today, in addition to the new Income Tax Bill, 2025. Read this article to get the key highlights of the New Income Tax Bill 2025.

Objectives of the New Income Tax Bill 2025

- Simplification: Less complexity and more clarity.

- Increased Compliance: Simplify tax filing and assessment.

- New Taxation Framework: Bring tax laws in line with international best practices.

- Transparency & Accountability: Establish taxpayer rights and responsibilities.

- Digital Taxation: Enhance the faceless assessment and appeal system.

Key Highlights of the New Income Tax Bill

No Change in Tax Rates

The bill does not introduce any new taxes or alter the existing tax rates. All tax rate modifications will continue to be made via the annual Finance Act.

Introduction of the ‘Tax Year’ Concept

- The ‘assessment year’ has been removed, and the ‘tax year’ now aligns with the financial year (April 1 – March 31).

- For businesses or newly set-up professions, the tax year begins from their establishment date.

Clearer Tax Slabs under the New Regime

The government aims to promote the new tax regime by refining its structure:

| Income Slab | Tax Rate |

|---|---|

| ₹0 – ₹4,00,000 | 0% |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| ₹24,00,001 & above | 30% |

Faceless Jurisdiction for Appeals

- Faceless tax assessments and appeals continue, reducing the need for physical interactions with tax authorities.

- AI-driven assessments to prevent corruption and delays.

Introduction of a Taxpayer Charter

- Explicitly outlines taxpayer rights and obligations.

- Aims to reduce taxpayer grievances and ensure fair treatment.

Streamlined Compliance and Filing Process

- Pre-filled tax returns with more details to reduce errors.

- Standardized reporting format for businesses and individuals.

- Faster refunds through real-time processing.

Enhanced Tax Benefits for Startups & MSMEs

- Reduced tax burden on startups with relaxed compliance norms.

- Tax exemptions for newly incorporated startups for a defined period.

Revised Capital Gains Tax Structure

- Clearer classification of short-term and long-term capital gains.

- Simplified rates to make capital gains taxation more transparent.

Digital Economy & Crypto Regulations

- Crypto transactions now have a well-defined taxation structure.

- GST-like compliance system for digital transactions to avoid tax evasion.

Penalty Reforms & Dispute Resolution

- Lower penalties for voluntary disclosure of tax errors.

- More structured tax tribunals to resolve disputes quickly.

Expanded Definition of Income

- Virtual digital assets (VDAs) like cryptocurrency and NFTs are now considered capital assets, similar to land and shares, affecting tax calculations.

Simplified and Concise Drafting

- The Bill reduces the number of provisos and cross-references, making it easier to interpret without relying on multiple sections and rules.

Consolidation of Tax Compliance Requirements

- Provisions related to TDS, assessment timelines, dispute resolution, and deductions have been tabulated for easier access.

Removal of Outdated Exemptions

- Provisions like Section 54E (capital gains exemption for pre-1992 asset transfers) and redundant sections from past amendments have been eliminated.

Detailed Deductions from Salary

- Deductions related to salary, including standard deductions, gratuity, and leave encashment, are now detailed in tabular form, providing taxpayers with clear guidance.

Salient Features of the New Income Tax Bill 2025

- The current law is made simpler and shorter by the new bill, which cuts its length from over 800 pages to 622 pages.

- It is easier to grasp since it eliminates out-of-date clauses and displays tax rates in an easy-to-read tabular style.

- Introduction of “Tax Year”: To reduce misunderstanding, the measure substitutes the word “tax year” for phrases like “assessment year” and “financial year.” The twelve months starting on 1st April will be known as a tax year.

- Enhanced Clarity: The bill aims to simplify tax rules by eliminating unnecessary sections and footnotes, making them easier to understand. This strategy seeks to minimise legal complications and promote voluntary compliance.

- Timeline for Implementation: The Income Tax Act, 2025, will go into effect on April 1, 2026, if it is passed, providing experts and taxpayers ample opportunity to become used to the new rules.

Changes in Search and Seizure Provisions

Powers Extended to Virtual Digital Spaces

- The new bill gives power to override any access codes (passwords, passcodes, encryption keys) protecting an individual’s digital communication or accounts.

Existing Powers Under the Income Tax Act, 1961

- Tax authorities could enter and search premises and forcibly open locks to seize financial records.

- Officials were already examining electronic records like emails, hard disks, and desktops.

New Powers Under Proposed Income Tax Bill, 2025

Authorities can now access “virtual digital spaces“ such as:

- Email servers, Social media accounts (Facebook, Twitter, Instagram, etc.)

- Online banking and investment accounts

- Websites storing asset ownership details

- Cloud storage and remote servers, Digital application platforms, any other similar digital space.

This means tax officials can use password-breaking software or request tech companies (e.g., Apple, Google, Meta) to bypass login credentials.

Conclusion

The New Income Tax Bill 2025 is a landmark reform designed to make taxation simpler, fairer, and more efficient. By modernising compliance procedures, introducing a Taxpayer Charter, and promoting faceless tax assessments, the government aims to enhance transparency and ease of doing business.

Taxpayers should stay updated on CBDT notifications and consult financial experts to understand how these changes impact them. With a structured transition phase, this new bill is set to redefine India’s direct taxation landscape.

| Related Articles | |

| New Tax vs Old Tax | Tax System in India |

| Why the Tax Cuts are a One-Way Gamble? | Central Board of Direct Taxes (CBDT) |

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

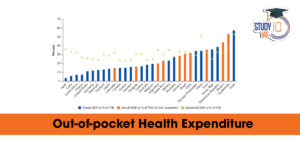

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...