Table of Contents

Context: The recent U.S. decision to impose 50% tariffs on Indian imports, including a 25% penalty linked to India’s oil trade with Russia, threatens India’s export competitiveness. Since the U.S. is India’s largest export market for textiles, pharmaceuticals, and IT services, such steep tariffs could aggravate India’s trade deficit, job losses, and farmer distress.

Why This Is a Challenge for India

- Erosion of competitiveness – Indian goods become costlier than rivals from Vietnam or Bangladesh.

- Export dependence – The U.S. is a major market for textiles, pharma, and services; higher tariffs hurt foreign exchange earnings.

- Pressure on agriculture – U.S. seeks dairy and farm access in return, threatening India’s farmers.

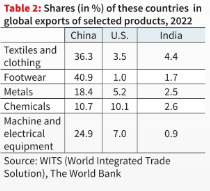

- Limited global market alternatives – China dominates global exports (36% textiles vs. India’s 4.4%).

- Structural weakness – India still relies on low-cost labour instead of technology-led competitiveness.

Why the China Model Cannot Be Replicated in India

- Different Political Systems: China’s authoritarian one-party state enabled rapid decision-making, large-scale land acquisition, and suppression of dissent.

- India’s democratic polity, coalition politics, and federal structure make top-down execution much slower.

- Export-Led Growth vs. Domestic Market Realities: China relied on low-cost manufacturing + exports to the West for 3 decades.

- With protectionism rising and Western demand stagnating, India cannot depend on the same path.

- Land and Labour Constraints: China built massive industrial zones through easy land acquisition and low-cost, disciplined labour.

- In India, land acquisition faces legal, political, and social hurdles; labour reforms are still incomplete.

- Infrastructure Financing: China financed growth through state-led investment, high domestic savings, and a debt-fueled infrastructure push.

- India’s savings rate is lower, fiscal space is tighter, and public debt limits massive state-driven investment.

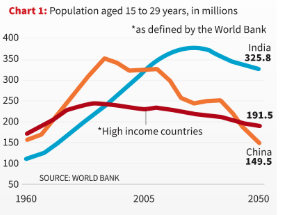

- Demographic Timing: China’s demographic dividend peaked during its export boom.

- India’s youth bulge is happening when global trade is slowing and automation threatens low-skill jobs.

- Innovation Ecosystem: China quickly transitioned from “factory of the world” to a tech and R&D powerhouse with state support.

- India’s R&D spending is <1% of GDP (vs. China’s ~2.4%), and private sector participation is weak.

How Indian Youth Can Be the Solution

- Demographic Dividend Advantage: With 1 in 5 young people in the world living in India, the youth can power domestic consumption and also form a skilled global workforce.

- Unlike China’s ageing population, India still has a window of 2–3 decades to leverage this advantage.

- Skilled Workforce for Knowledge Economy: Investing in STEM education, digital skills, and vocational training can turn India’s youth into the backbone of IT, AI, green tech, and biotech industries.

- This would help India move up the global value chain beyond low-cost manufacturing.

- Boost to Domestic Demand: Rising youth wages and incomes can create a large middle-class consumer base, reducing overdependence on exports to the U.S./Europe.

- This supports the shift towards a domestic demand–driven growth model.

- Entrepreneurship & Start-up Ecosystem: India already has the 3rd largest start-up ecosystem, largely youth-led.

- With policy support, young entrepreneurs can create jobs, innovate in sectors like fintech, agri-tech, and health-tech, and reduce vulnerability to global tariff shocks.

- Innovation & R&D: Youth-led innovation in renewable energy, AI, pharmaceuticals, and space tech can reduce import dependence and strengthen global competitiveness.

- India’s diaspora success story in the U.S. shows what skilled youth can achieve with opportunities.

- Soft Power & Global Influence: India’s young professionals abroad enhance brain circulation, global linkages, and India’s reputation in technology and research.

- Strategic use of this diaspora can strengthen India’s bargaining power with the U.S. and others.

German Chancellor Visit to India in 2026...

German Chancellor Visit to India in 2026...

Iran Nuclear Crisis and India’s Role f...

Iran Nuclear Crisis and India’s Role f...

H1B Visa Program, Beneficiaries, Eligibi...

H1B Visa Program, Beneficiaries, Eligibi...