Table of Contents

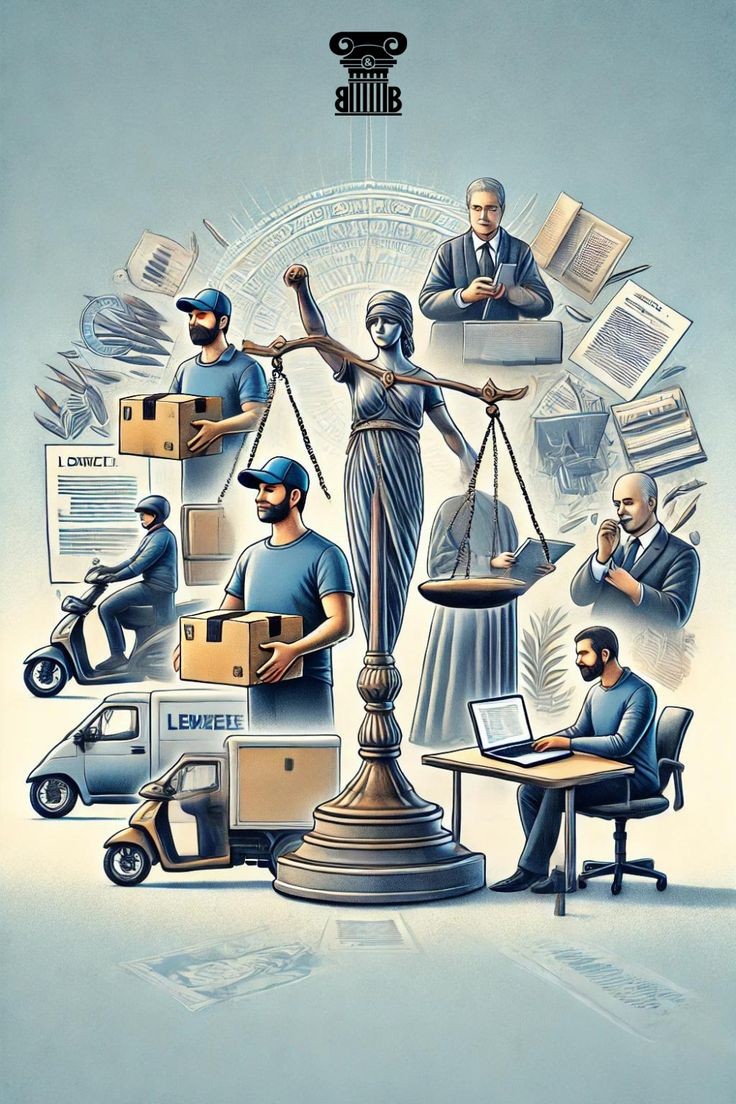

Context: India’s labour sector is seeing a significant transformation, driven by swift digitalisation, platform-based services, and an increasing inclination towards flexible work arrangements. The core of this revolution is the gig economy – a system of workers functioning outside conventional employer-employee dynamics, mostly propelled by digital platforms. Although authorities are increasingly acknowledging the significance and vulnerability of gig and platform workers, India’s official labour statistics, especially the Periodic Labour Force Survey (PLFS), have not yet adapted accordingly.

Defining Gig and Platform Work: Legislative Recognition

- The first notable legislative acknowledgement of gig and platform workers occurred with the Code on Social Security, 2020, which, pursuant to Section 2(35), delineates a gig worker as:

- A person who engages in labour beyond the conventional employer-employee dynamic and derives income from such activities.

- Furthermore, Section 2(61) delineates platform work as follows:

- A labour arrangement that deviates from a conventional employer-employee relationship, wherein organisations or individuals utilise an online platform to engage with other organisations or individuals to address specific issues or deliver certain services.

- These definitions, while innovative in recognising a new type of labour, are criticised for their imprecision and insufficient operational clarity, particularly in the context of statistical enumeration or policy execution.

- Consequently, gig workers occupy an uncertain status within India’s extensive labour law framework, which has traditionally focused on the dichotomies of formal/informal and organised/unorganised labour.

Statistical Invisibility: The Limits of PLFS Classification

- Notwithstanding legislative progress, India’s principal labour statistics source, the Periodic Labour Force Survey (PLFS), does not adequately differentiate between gig and platform employment.

- The PLFS persists in categorising such labour under vague and ambiguous classifications such as “self-employed,” “casual labour,” or “own-account worker.”

- This ambiguous definition creates a significant gap: policymakers, who depend on the PLFS for evidence-based reforms, are unable to appropriately evaluate the scale, circumstances, or requirements of gig workers.

- The 2025 PLFS modification incorporated an expanded sample size, monthly estimates, and more rural representation; nonetheless, it did not provide a specific classification for gig workers.

- In reply to a legislative inquiry, the Ministry of Statistics and Programme Implementation affirmed that the PLFS Schedule had not been revised to explicitly include gig workers, although they asserted that all market-based activities are encompassed.

- This blanket inclusion, however, simplifies the intricate realities of gig employment, which is frequently regulated by algorithms, dispersed across several platforms, and devoid of formal contracts.

- In contrast to conventional self-employed individuals, gig workers typically do not possess the means of production, have unstable income, and are subject to digital monitoring and ranking systems.

- Consequently, their labour conditions do not conform to established statistical classifications, so diminishing both their visibility and their access to social security programs.

The Growing Gig Workforce in India

- India is experiencing a significant increase in gig and platform jobs.

- NITI Aayog’s 2022 report, “India’s Booming Gig and Platform Economy,” projected the gig workforce at 7.7 million in 2020-21, projecting it to grow to 23.5 million by 2029-30.

- The survey indicates that approximately 47% of gig workers are classified as medium-skilled, 22% as high-skilled, and the remaining 31% as low-skilled.

- Gig workers encompass a diverse array of positions, including food delivery (Swiggy, Zomato), ride-hailing (Ola, Uber), home services (Urban Company), e-commerce logistics (Flipkart, Amazon), freelance professionals, and content creators.

- These positions are generally task-oriented, frequently devoid of social protection, and function without long-term stability; however, they are the foundation of India’s digital economy.

Significance and Recent Developments in Indian Labour Laws

The Indian government has implemented gradual measures to safeguard gig workers, acknowledging their vulnerability.

The Social Security Code, 2020

This Code is the first legislation to formally recognise gig and platform workers, incorporating measures such as:

- Clause 141: Creation of a Social Security Fund for unorganised, gig, and platform workers.

- Section 6: Establishes the National Social Security Board to propose and oversee programs.

- Voluntary Registration: Workers can register on platforms such as e-Shram to access benefits.

e-Shram Portal

- Initiated in 2021, e-Shram is a digital platform designed for the registration of unorganised workers, encompassing gig workers.

- As of 2025, about 280 million workers have registered, while apprehensions regarding data integrity and the efficacy of benefit distribution continue.

Ayushman Bharat and Additional Initiatives

- Certain gig workers are receiving healthcare benefits through Ayushman Bharat PM-JAY, while specific state governments, like as Rajasthan, have implemented dedicated legislation, including the Gig Workers Welfare Act, 2023, which provides protections such as accident insurance and basic working requirements.

- Notwithstanding these efforts, the absence of formal employer accountability, a regulatory authority, and non-standard work arrangements persistently hinders the effective execution of these legislative provisions.

International Context: Global Responses to the Gig Economy

Globally, governments are confronting identical challenges:

- The European Union is poised to implement a Platform Work Directive, proposed in 2021, aimed at elucidating work status and guaranteeing minimal rights, including transparency in algorithms.

- United Kingdom: The 2021 Supreme Court ruling in Uber BV v. Aslam determined that Uber drivers qualify as “workers” entitled to minimum wage and paid leave.

- The United States: States such as California enacted legislation like AB-5, intending to reclassify numerous gig workers as employees; however, implementation has encountered resistance.

These developments demonstrate that the worldwide legal community is progressing toward reclassifying gig workers as a distinct third category, apart from both employees and independent contractors, to guarantee hybrid rights and protections.

Judicial Interpretation in India

- In People’s Union for Democratic Rights v. Union of India (1982), the Supreme Court held that even “non-traditional” forms of employment must be scrutinised through a constitutional lens, especially under Article 21 (Right to Life) and Article 23 (Right against Exploitation)- principles increasingly relevant to gig workers’ precarious conditions.

- Courts have also cited the Directive Principles of State Policy, especially Article 43, which urges the State to ensure just and humane work conditions, including for informal and gig workers.

Way Forward

- Notwithstanding recognition, representation continues to be unattainable. In the absence of data disaggregation, policy actions will be inadequate. To establish a genuinely inclusive policy framework:

- The PLFS must integrate new classification codes or modules that specifically identify gig and platform workers.

- Regulations should incorporate algorithmic accountability, income stability, and standardised contracts.

- State governments ought to be urged to implement frameworks like Rajasthan’s Gig Workers Welfare Act.

- Tripartite boards of government, platform representatives, and workers can be established to negotiate norms and welfare conditions.

- Furthermore, India’s initiative for Digital Public Infrastructure (DPI) ought to encompass labour visibility infrastructure by integrating e-Shram, Aadhaar, social security databases, and application-based work records.

- The 2025 Union Budget and legislative measures like the Code on Social Security signify crucial advancements in India’s recognition of gig workers as legitimate contributors to the labour economy.

- Nonetheless, acknowledgement devoid of representation, whether statistical or legal, equates to exclusion.

- Gig employment, with its intricacies, undermines the traditional distinctions of labour law and statistical categorisation.

- India must implement an innovative, rights-oriented, and data-informed framework that guarantees both the dignity of labour and economic justice in the platform economy.

- As India aims to achieve a $5 trillion economy, the gig workforce is not ancillary; it is pivotal. A new social compact is not merely desirable; it is imperative.

Faster Is Not Fairer: Reassessing POCSO ...

Faster Is Not Fairer: Reassessing POCSO ...

Prevention of Corruption Act, 1988: Evol...

Prevention of Corruption Act, 1988: Evol...

The Securities Markets Code, 2025: Conso...

The Securities Markets Code, 2025: Conso...