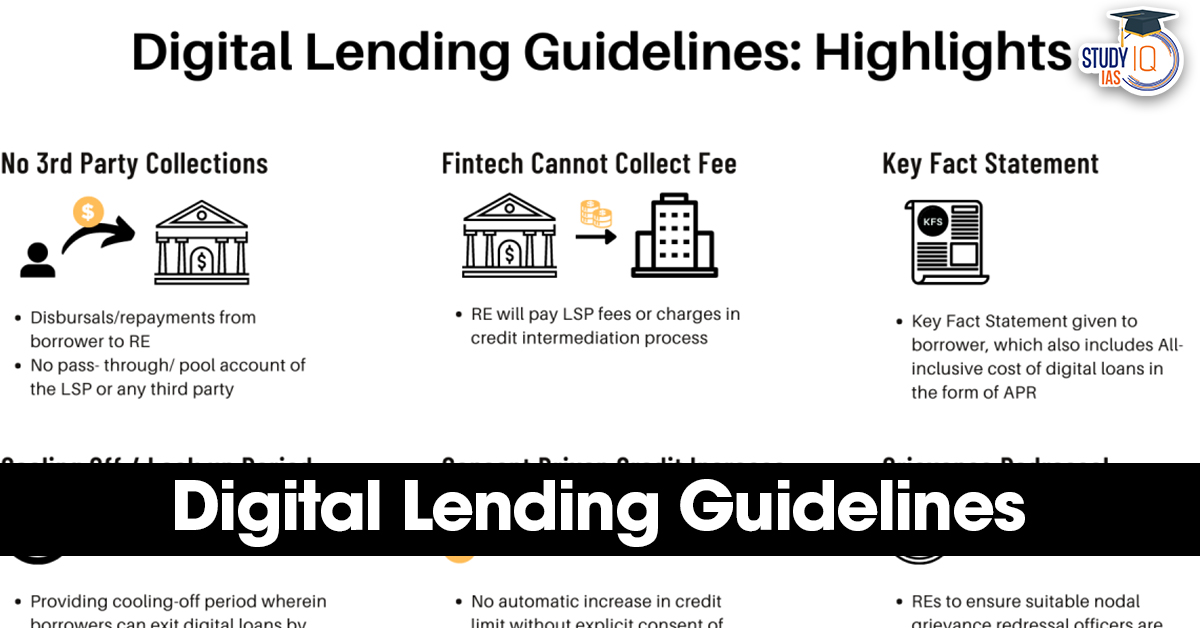

Context: The Reserve Bank of India issued consolidated ‘digital lending directions’ with two new sets of instructions.

More in News

- Covers lending service providers (LSPs) working with regulated entities (REs).

- Operationalises a Public Directory of Digital Lending Apps (DLAs).

What are the new Digital Lending Guidelines 2025?

- Digital View of Loan Offers: Borrowers must be shown comparable loan offers from all eligible lenders, along with transparent details like interest rate, loan amount, tenure, penal charges, etc.

- Cooling-off Period: Allows borrowers to exit loans within a specified time.

- Data Privacy & Consent: Borrowers can revoke consent and request data deletion.

- Public Registry of DLAs: All digital lenders must now register their apps on the RBI’s Centralised Information Management System (CIMS).

- A list of authorised lending apps will be published and regularly updated on RBI’s website.

- Accountability of REs: REs are responsible for compliance by their partnered LSPs.

- Grievance Redressal: REs and LSPs must set up mechanisms to address borrower complaints efficiently.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...