Coconut Oil Taxation in India

- Background: The dispute was on whether coconut oil, packaged in quantities from 5 ml to 2 litres, should be taxed as edible oil or hair oil

- Prior to GST Regime:

- Taxation Under the CET Act, 1985: Prior to GST, coconut oil was taxed under the Central Excise Tariff Act, 1985 (CET Act).

- In 2005, the CET Act classified coconut oil under Section III as “Animal or Vegetable Fats and Oils” with an 8% excise duty, distinguishing it from haircare products under Section VI, which carried a 16% excise duty.

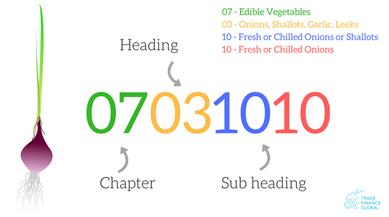

- These classifications followed international norms set by the Harmonised System of Nomenclature (HSN) by the World Customs Organisation.

| World Customs Organisation (WCO) |

Harmonized System of Nomenclature Code (HSN)It is a six-digit identification code developed by WCO in 1988. It helps in systematic classification of goods across the globe.

|

- After introduction of GST:

- Coconut oil was categorized under edible oils, attracting a 5% tax.

- Haircare products under the category “Preparations for use on the hair” continued to attract a higher tax rate of 18%.

| Facts |

|

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

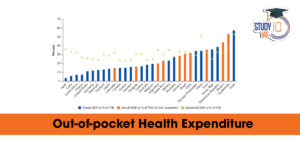

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...