Table of Contents

Context: NITI Aayog released its report “Chemical Industry: Powering India’s Participation in Global Value Chains”

Status of Chemical Industry in India

Size & Contribution:

- India is the 6th largest chemical producer in the world and 3rd in Asia.

- Contributes over 7% to India’s GDP; accounts for ~13% of total industrial output.

- Employs over 2 million people.

- India’s share in the global chemical value chain: ~3.5%.

- Chemical trade deficit: USD 31 billion (2023) due to high dependence on imports, especially for speciality chemicals and feedstock.

Potential:

- Rapid growth in demand for speciality and green chemicals.

- Government targets a $1 trillion chemical sector by 2040, aiming for 12% global value chain share.

- Expected to generate significant exports and skilled jobs with focused interventions.

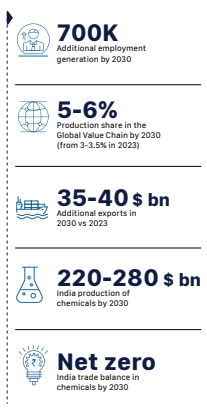

Vision for 2030:

- Target: 5-6% share in global chemical value chain, double current production, net-zero trade deficit, USD 35-40 billion extra exports, and 7 lakh new skilled jobs.

- Modern clusters, advanced tech adoption, regulatory streamlining, robust talent pool.

Challenges Facing the Indian Chemical Sector

- High Import Dependence: Heavy reliance on imported feedstock and speciality chemicals; limited domestic backward integration.

- Infrastructure Gaps: Outdated chemical clusters, and inadequate port and logistics infrastructure lead to higher costs than global competitors.

- Low R&D Investment: R&D spending only 0.7% (global average 2.3%), restricting innovation in high-value chemicals.

- Regulatory Delays: Lengthy and opaque environmental clearance processes stifle agility and add compliance burden.

- Talent Shortages: 30% shortfall in skilled professionals, especially in emerging areas like green chemistry, nanotech, and safety.

- Fragmented Industry: A large number of small, fragmented players with low economies of scale.

Solutions / Interventions Proposed by NITI Aayog

- World-Class Chemical Hubs: Upgrade and build new clusters; empower central committee and dedicated chemical fund for shared infrastructure.

- Strengthen Port & Cluster Infrastructure: Develop high-potential clusters; improve port infrastructure with advisory chemical committees.

- Opex Subsidy Scheme: Incentivize incremental production, import substitution, and export-oriented production through targeted subsidies.

- Boost R&D and Technology Access: Allocate more funds for R&D; foster industry-academia partnerships; acquire advanced tech via global tie-ups.

- Fast-Track Regulatory Approvals: Simplify and accelerate environmental clearance; enhance transparency and accountability.

- Strategic FTAs: Negotiate FTAs with specific provisions for the chemical sector; improve exporter awareness and utilization.

- Skill Development: Expand ITIs and specialized institutes; upgrade faculty; promote industry-relevant curriculum and training.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...