Table of Contents

Context: In the times of unpredictability and an increase in the frequency of extreme weather events, such as cyclones, floods, forest fires, and devastating earthquakes in South Asia, the need for cat bonds is highlighted.

What are Cat Bonds (Catastrophe Bonds)?

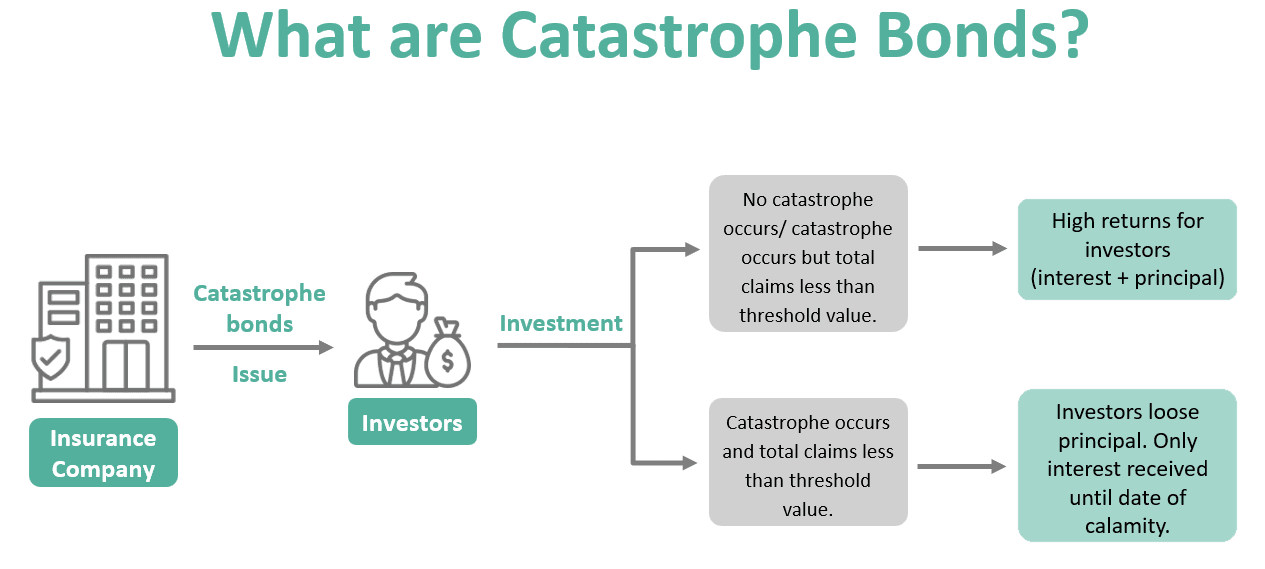

- Cat Bonds (Catastrophe Bonds) are a type of insurance-linked security that allows the transfer of risk from large-scale disaster events (such as earthquakes, hurricanes, or floods) from the issuer (often a government or insurer) to investors in the financial market.

- Purpose: They provide quick post-disaster funds for recovery and reconstruction by converting insurance risk into tradable securities.

How is a Cat Bond Issued?

- Sponsorship: Typically, a sovereign government, insurer, or reinsurer (the “sponsor”) identifies specific disaster risks to insure against (e.g., a cyclone of a certain magnitude).

- Intermediary: The sponsor works with an intermediary (e.g., World Bank, Asian Development Bank, or a reinsurance company) to structure and issue the bond.

- Investment: Investors purchase the bonds, providing upfront capital (the “principal”).

- Terms: The bond outlines trigger conditions (e.g., earthquake above magnitude 7), duration, and payout mechanisms.

- Premiums & Coupons: The sponsor pays periodic premiums (high coupon rates) to the investors for taking on the risk.

|

Facts |

Does India Need Catastrophe Bonds?

|

| Pros of Cat Bonds | Cons of Cat Bonds |

| Risk diversification | Trigger risk – if meet pre-defined trigger parameters, no payout. |

| Rapid payouts | High costs (higher coupon rates) |

| Portfolio diversification | Structural complexity |

| Access to global capital | Limited investor interest (market size) |

| Encourages mitigation | Potential for risk mispricing |

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...