Table of Contents

Context: A report by the Centre for Science and Environment (CSE) has revealed flaws in the voluntary carbon market in India, which is seen as an important tool in combating climate change.

Understanding Carbon Markets

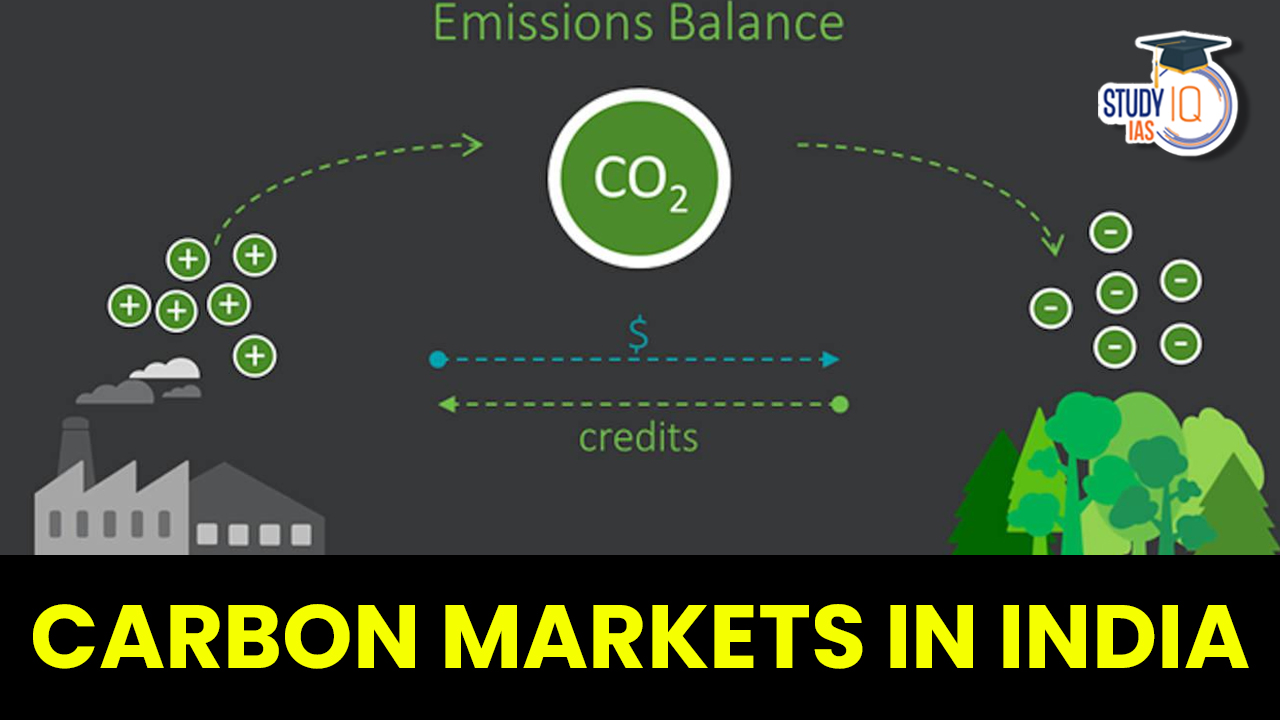

- Carbon markets are trading systems in which carbon credits are sold and bought.

- Carbon credits, also known as carbon offsets, are permits that allow the owner to emit a certain amount of carbon dioxide or other greenhouse gases.

- Companies or individuals can use carbon markets to compensate for their greenhouse gas emissions by purchasing carbon credits from entities that remove or reduce greenhouse gas emissions.

- The concept of carbon markets started formally in 1997 under the United Nations’ Kyoto Protocol.

Types of Carbon Markets

- Compliance carbon markets: They are set up by policies at the national, regional, and/or international level and are officially regulated. Examples include:

- The European Union Emissions Trading System (EU ETS).

- The Regional Greenhouse Gas Initiative (RGGI) in the United States.

- The California Cap-and-Trade Program.

- The China Emissions Trading Scheme.

- Voluntary carbon markets: These are not regulated by governments or other regulatory bodies.

- In voluntary markets, credits are verified by private firms as per popular standards.

About the EU emissions trading system (EU ETS)

- It is a carbon market based on a system of cap-and-trade of emission allowances for energy-intensive industries and the power generation sector.

- The EU sets a cap on how much CO2 can be emitted – which decreases each year – and companies need to have a European Emission Allowance (EUA) for every tonne of CO2 they emit within one calendar year.

- It is the EU’s main tool in addressing emissions reductions. Since its introduction in 2005, the EU’s emissions have decreased by 41%.

Advantages and Disadvantages of Carbon Markets

| Advantages | Disadvantages |

|

|

Status of the Carbon Market in India

- In June 2023, the Union power ministry issued a notification on its Carbon Credit Trading Scheme.

- Under this, the government would constitute a National Steering Committee for the Indian carbon market.

- The committee would be tasked with the governance of the Indian carbon market.

- The Bureau of Energy Efficiency, an agency under the power ministry would be the designated administrator of the Indian carbon market.

- It will also issue carbon credits based on the recommendations provided by the committee.

- The Grid Controller of India Limited shall act as the registry and the Central Electricity Regulatory Commission will be the regulator.

- Simultaneously, the Union environment ministry in June 2023, notified the Draft Green Credit Programme Implementation Rules, 2023.

- The programme is a domestic voluntary market that incentivizes voluntary environmental actions so that it promotes government’s Mission LiFE (Lifestyle for Environment).

- It has listed actions, including planting trees, which would get “green credits”.

- These green credits will be traded on a domestic market platform.

Key Highlighst of the Centre for Science and Environment (CSE)’s Report

Status of the Voluntary Carbon Markets

- The world has two leading voluntary carbon markets – Verra and Global Standard.

- Together, they have 6,481 projects registered;

- Till May 2023, they have issued 1.4 billion carbon credits.

- India is the world’s second largest supplier of carbon credits.

- India’s voluntary carbon market is worth over US $1.2 billion, and the country has 1,451 projects listed with the two global markets named above.

- Indian entities have already earned about US $652 million from carbon credits used to offset emissions.

Flaws in the Voluntary Carbon Markets in India

- Secrecy and Lack of Transparency: Details of projects, pricing of carbon credits, and other critical information are often kept hidden from public scrutiny.

- Community Rights: Despite projects being carried out in various communities across India to generate carbon credits, the local communities are rarely aware of their involvement or have rights over the carbon credits generated.

- Overestimation of Emissions Reduction: The investigation found instances of overestimation of emissions reductions in various projects, which can lead to inaccurate accounting of carbon credits.

- Profiteering: The voluntary carbon market appears to serve the interests of project developers, and auditors with little benefit reaching the communities involved in these projects.

Recommendations by the Report

- Ensure Transparency: Details of carbon credit projects should be made publicly available, including project specifics and pricing information.

- Pay for Real Change: Define the objectives of the carbon market clearly, whether voluntary, bilateral, or multilateral, and design rules accordingly.

- Share the Proceeds: Carbon market proceeds should be shared with local communities in a verifiable manner.

- Keep It Simple: Design projects with simplicity in mind to avoid overestimation of emissions reductions.

- Countries Must Account: The voluntary carbon market should align its activities with a country’s Nationally Determined Contributions (NDCs).

Question Hour in Parliament: Meaning, Ty...

Question Hour in Parliament: Meaning, Ty...

Daily Quiz 18 July 2025

Daily Quiz 18 July 2025