Table of Contents

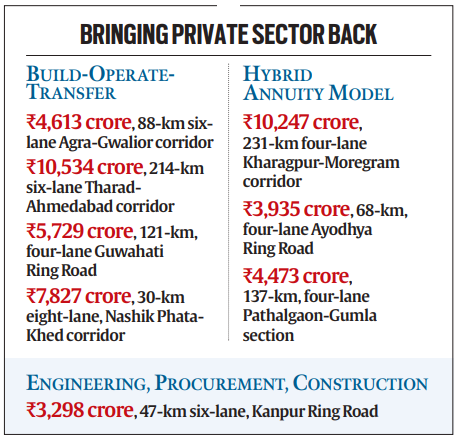

Context: The Union government has approved 8 national high-speed corridor projects at a cost of Rs 50,655 crore.

More in News

- This initiative is expected to generate 4.42 crore man-days of direct and indirect employment.

- 4 of the 8 highways will be executed under the Build-Operate-Transfer (BOT) model.

- The other 4 highways include three Hybrid Annuity Model (HAM) projects and one Engineering, Procurement, and Construction (EPC) project.

About Public-Private Partnership Model (PPP)

- PPPs are collaborations between government and private sector entities for the provision of public assets and services, enabling large-scale projects such as roads, bridges, or hospitals to be completed with private funding.

- In PPPs, private sector entities undertake investments for a specified period.

- PPPs are commonly used for large-scale infrastructure projects like public transportation systems, highways, bridges, hospitals, schools, and parks.

- The government retains full responsibility for providing services, so PPPs do not equate to privatisation.

- There is a clear allocation of risk between the private sector and the public entity.

- Private entities are selected through open competitive bidding and receive performance-linked payments.

- PPPs are particularly beneficial in developing countries where governments face borrowing constraints for essential projects, offering the necessary expertise in planning and execution.

- Advantages:

- Efficiency: Combines private sector efficiency and innovation with public sector accountability and social objectives.

- Expertise: Leverages private sector expertise in areas such as technology and project management.

- Economic Benefits: Can stimulate economic growth by creating jobs and improving infrastructure.

Models of Public-Private Partnership (PPP) in Highway Development

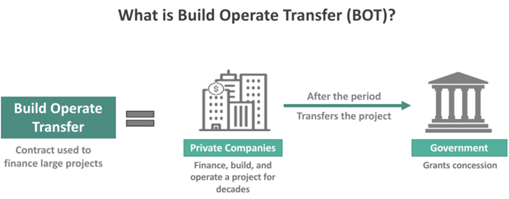

1. Build-Operate-Transfer (BOT)

- Build-Operate-Transfer (BOT) Annuity Model

- The developer builds the highway, operates it for a specified duration, and then transfers it back to the government.

- The government begins payments to the developer after the project starts commercial operations, with payments made every six months.

- Build-Operate-Transfer (BOT) Toll Model

- The developer constructs the road and recovers the investment through toll collection over a period of up to 30 years.

- There is no government payment to the developer; the developer earns revenue solely from tolls.

2. Engineering, Procurement, and Construction (EPC) Model

- The government bears the entire cost of the project.

- The government invites bids for engineering expertise from private players, while it procures raw materials and covers construction costs.

- The model imposes a high financial burden on the government due to full cost responsibility.

3. Hybrid Annuity Model (HAM)

- HAM combines elements of the BOT Annuity and EPC models.

- The government contributes 40% of the project cost over the first five years through annual payments.

- The remaining 60% is paid based on the assets created and the performance of the developer, with the initial 40% paid in five equal instalments and the rest as variable annuity amounts after project completion.

- The developer must raise the remaining 60% of the project cost through equity or loans.

- The National Highways Authority of India (NHAI) is responsible for revenue collection; the developer does not have toll rights.

- HAM provides liquidity to the developer and shares financial risk with the government. The developer bears construction and maintenance risks but only partly bears the financing risk.

- HAM is intended for stalled projects where other models are not suitable.

| What Does Hybrid Annuity Mean? |

| In financial terminology, hybrid annuity means that payment is made in a fixed amount for a considerable period and then in a variable amount in the remaining period. |

Challenges in Public-Private Partnership (PPP) Models

- Policy and Participation:

- Lack of significant success in private participation despite policy measures.

- Infrastructural gaps in almost all sectors, threatening sustained growth.

- Limited success in railways, civil aviation, and social sectors.

- Economic and Financial Constraints:

- Weak regulatory and institutional frameworks.

- Inadequate diligence and appraisal by lenders.

- Financing issues and delays in the issuance of clearances.

- Inappropriate risk allocations and one-size-fits-all approaches to MCAs.

- Aggressive bidding by developers leading to contractual issues.

- Increasing number of non-performing assets (NPAs) held by domestic lenders.

- Infrastructure Leasing & Financial Services (IL&FS) crisis restricting funding options.

- Impact of the global economic slowdown on the demand for goods and services.

- Regulatory and Institutional Issues:

- Inadequate dispute resolution mechanisms.

- Environmental issues delaying project implementation.

- Funding and Investment Challenges: Limited options for domestic lenders and restricted international credit and financing markets.

- Need for innovative instruments and mechanisms to enhance foreign investments.

Way Forward for Revitalising PPPs

- Strengthening Lending Institutions: Enhance the capacities of institutions like India Infrastructure Finance Company, infrastructure debt funds, and the International Finance Corporation (IFC).

- Establish 3P India with a ₹5 billion (US$70 million) corpus to support PPPs.

- Reforming Viability Gap Funding (VGF): Update the VGF scheme to address market challenges and attract more private investment.

- Access to Long-Term Debt: Facilitate access to long-term debt from insurance, pension, and provident fund companies.

- Expand bond markets and use credit enhancement measures through government guarantees.

- Debt Management: Refinance existing debt and restructure non-performing assets (NPAs) of banks.

- Review current restrictions on group exposures of banks to enable more significant investment.

- Enhancing Foreign Investments: Develop innovative instruments and mechanisms to attract foreign capital inflows.

- Offer equity in completed and successful infrastructure projects to long-term investors, including foreign institutional investors.

- Dispute Resolution: Establish the Infrastructure PPP Adjudicatory Tribunal as recommended by the Kelkar Committee for faster dispute resolution.

- Set up independent regulators in sectors lacking them and streamline the roles of existing regulators.

- Model Concession Agreements (MCAs): Review and customise MCAs for each sector to ensure they represent the interests of all stakeholders, including users, project proponents, concessionaires, lenders, and markets.

- Legal Reforms: Amend the Prevention of Corruption Act, 1988, to distinguish genuine errors in decision-making from acts of corruption, preventing witch-hunts against bureaucrats.

Effectiveness of Tobacco Taxation in Ind...

Effectiveness of Tobacco Taxation in Ind...

Private Sector Participation in Defence ...

Private Sector Participation in Defence ...

India–France Strategic Cooperation in ...

India–France Strategic Cooperation in ...