Context: The Indian government has saved ₹560 crore in interest costs in the current FY 2026, by switching short‑term bonds to longer‑term securities, extending its debt maturities and reducing immediate repayment and interest pressure.

About Bond Switching

- Definition: Bond switching is when the government (through the RBI) exchanges existing bonds for new ones with different maturities, coupon rates, or both.

- Purpose: Mainly used to extend debt maturity, manage redemption pressure, and reduce interest costs.

Mechanism

- The government offers to swap short-term bonds nearing maturity for longer-term securities.

- Investors (like banks, mutual funds, and insurers) exchange their holdings voluntarily.

Benefits to Government

- Spreads out repayment obligations over a longer period.

- Reduces the immediate cash outflow and can lower average borrowing costs.

- Smoothens the debt maturity profile, avoiding large repayment spikes.

Benefits to Investors

- Provides flexibility to align portfolios with investment goals.

- It can help lock in favourable yields for a longer term.

Risks/Considerations

- Market demand for the switch depends on yield curve conditions.

- If interest rates rise, investors might be reluctant to accept longer maturities.

Example: In FY 2026 (so far), bond switching saved the Indian government ₹560 crore in interest costs compared to ₹54 crore in the same period last year.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

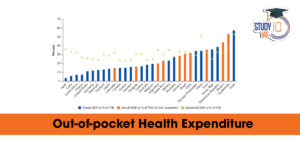

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...