Table of Contents

India’s defence manufacturing ecosystem is undergoing a structural transformation, marked by greater private-sector participation, higher domestic production, and rapidly expanding defence exports, positioning the country to strengthen self-reliance and emerge as a credible global defence supplier.

Current Status Of Defence Production in India

- Highest-ever defence production: ₹1.54 lakh crore in FY 2024–25.

- Indigenous defence production: ₹1,27,434 crore in FY 2023–24 (up 174% from 2014–15).

- Defence exports: Record ₹23,622 crore in FY 2024–25, to 80+ countries / over 100 nations.

- Ecosystem depth: 16,000 MSMEs, 788 industrial licences to 462 companies.

- Private sector role rising: About 23% share in total production (FY 2024–25).

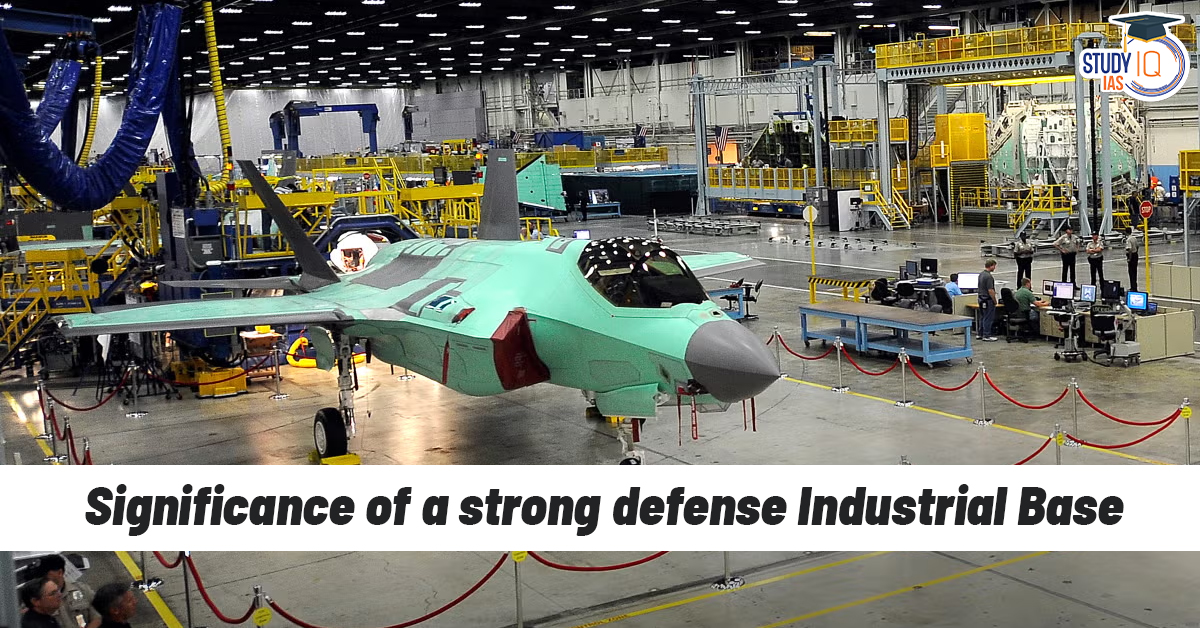

Significance of a strong defence industrial base

- Strategic autonomy: Reduces dependence on imports and insulates national security from global supply-chain disruptions.

- Operational readiness: Ensures timely availability of equipment during conflicts and crises.

- Economic gains: Generates high-skilled employment, boosts manufacturing value chains, and supports innovation.

- Export capability: Enhances India’s role in global defence markets amid rising international demand for cost-effective platforms.

- Geopolitical leverage: Signals technological maturity and reliability, strengthening diplomatic and strategic partnerships.

- Resilience: Nations with robust domestic defence industries demonstrate greater stability in volatile security environments.

Key issues and challenges

- Regulatory complexity: Lengthy procedures for export licensing, joint ventures, and technology transfer, particularly affecting MSMEs and startups.

- Policy uncertainty: Limited long-term demand visibility dampens private investment confidence.

- Institutional fragmentation: Overlapping roles across ministries hinder coordination and export facilitation.

- DRDO transition needs: Insufficient separation between frontier research and downstream production/commercialisation.

- Financing constraints: Limited access to competitive credit and specialised export financing instruments.

- Testing and certification bottlenecks: Stringent domestic standards, inadequate integrated testing facilities, and delayed trials.

- g., Naval systems or aerospace components undergo repeated trials, extending timelines by years.

- Ecosystem gaps: Need for a dedicated export facilitation agency and international certification alignment to compete with established global players.

Way Forward

- Simplify regulatory processes through single-window digital clearances, time-bound approvals, and fast-track mechanisms for MSMEs and startups.

- Provide long-term demand visibility by publishing multi-decade defence acquisition and indigenisation roadmaps with assured order commitments.

- Strengthen public–private partnerships by clearly delineating roles, with DRDO focusing on frontier research and industry leading production and commercialisation.

- Expand defence financing mechanisms, including export credit, guarantees, and lines of credit for foreign buyers of Indian defence equipment.

- Upgrade testing, trials, and certification systems by expanding integrated facilities, adopting international standards, and enforcing strict timelines.

- Focus on critical technology development via co-development partnerships, IPR sharing, and sustained R&D funding in engines, electronics, and sensors.

- Ensure policy stability and continuity to build investor confidence and support India’s defence export target of ₹50,000 crore by 2029.

Denotified Tribes and 2027 Census: Deman...

Denotified Tribes and 2027 Census: Deman...

Mummified Cheetahs Found in Saudi Arabia...

Mummified Cheetahs Found in Saudi Arabia...

NDMA Disaster Victim Identification Guid...

NDMA Disaster Victim Identification Guid...