Table of Contents

The Governor of the RBI released the National Strategy for Financial Inclusion 2025-30 (NSFI), which was earlier approved by the Sub-Committee of the Financial Stability and Development Council (FSDC-SC). NSFI: 2025-30 emphasises a synergistic ecosystem approach, improving the quality and consistency of last-mile access and effective usage of financial services. It lays down five strategic objectives (Panch-Jyoti) towards elevating the state of financial inclusion in the country.

Financial Inclusion is an important aspect of the UPSC Mains Syllabus. This article deals with the entire ecosystem of financial inclusion, its status, challenges and recommendations to improve it in India.

What is Financial Inclusion?

- “Process of ensuring access to financial services, timely and adequate credit for vulnerable groups such as weaker sections and low-income groups at an affordable cost.” – C Rangarajan Committee on Financial Inclusion (2008)

- “Convenient access to a basket of basic formal financial products and services that should include savings, remittance, credit, government-supported insurance and pension products to small and marginal farmers and low income households at reasonable cost with adequate protection progressively supplemented by social cash transfers, besides increasing the access of small and marginal enterprises to formal finance with a greater reliance on technology to cut costs and improve service delivery.” Deepak Mohanty Committee on Medium Term Path to Financial Inclusion (2015).

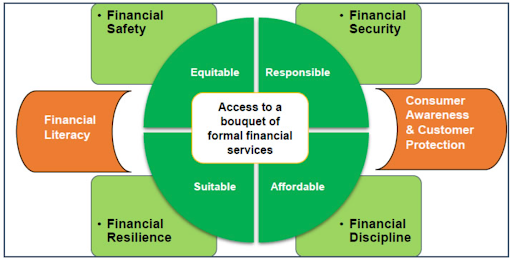

- Financial inclusion is ensuring availability of equitable, responsible, suitable, and affordable access to a bouquet of formal financial services, namely, savings, payments, remittances, credit, investments, insurance, and pension, across socio-economic and geographical strata, coupled with effective financial literacy, robust consumer awareness and customer protection measures. Financial inclusion improves the financial safety, financial security, financial resilience, and financial discipline of individuals (households) and micro-enterprises. – National Strategy for Financial Inclusion 2025-30

Status & Progress of Financial Inclusion in India

The past decade has resulted in significant improvements in access, usage, and quality of financial inclusion in India.

Robust Expansion of Physical Banking infrastructure:

- Moderate but consistent expansion in bank branches, ATMs, along with a rapid rise in the number of fixed point business correspondents (FBCs). FBCs have played a significant role in last mile reach of banking infrastructure.

- Banking infrastructure per lakh population has increased to 85.6 FBCs from 30.1 in 2019.

Usage of Banking Infrastructure

- Near saturation of bank account ownership.

Robust expansion of Digital banking & transactions & Usage

- An exponential increase in the volume of digital transactions led by Unified Payments Interface (UPI).

- Amongst the retail digital payments, there has been substantial growth across the board in national electronic funds transfer (NEFT), immediate payment service (IMPS) and UPI, with UPI touching more than 13,000 crore transactions in 2023-24.

Quality of Financial Inclusion – Financial Literacy

- Consistent rise in financial literacy programmes run by Centres for Financial Literacy (CFLs) and Financial Literacy Centres (FLCs), with CFLs touching more than 3.5 Crore participants.

Overall Progress – Financial Inclusion (FI Index)

- Financial Inclusion Index shows a consistent growth over the period of 5 years, with improvements seen across all the sub-indices. In 2024, the major growth in the index was due to the usage sub-index, which shows the deepening of financial inclusion.

Impediments or Challenges to Financial Inclusion in India

Supply Side Impediments to Financial Inclusion in India

- Non-dedicated BC outlets: Many BCs run financial services as a secondary business. This leads to poor quality & diluted service delivery.

- Low women’s representation: Gender imbalance restricts outreach to female customers.

- Restricted range of services: Remittances & cash services dominate; insurance, pensions, KCC/GCC loans often unavailable, leading to non-uniform service access.

- No standardisation: Lack of prescribed minimum services, signage, and bank linkage leading to poor monitoring & misaligned customer expectations.

- Inactive/closed BC points: High inactivity and clustering around markets/branches, leading to poor coverage in remote areas.

- Lack of timely & commensurate remuneration to BC agents.

- Difficulties in the commercial viability of BC outlets due to low transaction volume in certain pockets.

- Insufficient and lack of timely remuneration to banking correspondents leads to their inactivity, service apathy and unscrupulous practices amongst the BCs.

- Inadequate remuneration: Irregular or low pay leads to apathy, malpractice, and high turnover among BCs.

- Multiple bank affiliations: BCs working for multiple banks create accountability gaps.

- Hidden/unapproved charges: Fee display missing; unauthorised charges prevalent.

- Weak transaction confirmation systems: Lack of SMS/soundbox confirmation (especially in local languages) impacts trust.

- Poor grievance redressal visibility: Missing grievance boards, base branch details, ombudsman info.

- Connectivity & operational issues: Network failures, limited interoperability, transaction splitting, etc., hamper reliability.

Demand Side Impediment or Challenges to Financial Inclusion

1. Access & Usage of Bank Accounts

- Income-related barriers: Irregular income → no sustained deposits → dormant accounts.

- Preference for cash: Cultural familiarity and liquidity preference limit bank usage.

- Low awareness: Poor understanding of products (e.g., deposit insurance).

- Education as determinant: Lower education → lower trust, lower savings via banks.

- Urban–rural differences:

- Rural: greater trust in banks; reliance on BCs.

- Semi-urban: banking fees cited as barriers.

- Gender & mode of transaction:

- Women rely more on BCs; men more on digital.

- Higher income/education → shift to digital; ATM usage uniform across groups.

- Digital barriers despite smartphone ownership: Connectivity issues, complex UI, language barriers, fear of OTP/PIN breach.

2. Access & Usage of Credit

- High unmet credit demand:

- Lack of awareness of procedures

- Distance from nearest bank

- Lack of collateral

- Reliance on informal credit (16%): Higher in rural areas due to convenience, speed, and flexibility.

3. Access & Usage of Insurance & Pensions

- Income & education as strong enablers: Higher levels → greater uptake of insurance & pension products.

- Gender divide:

- Women lag in life insurance.

- Women slightly ahead in non-life insurance → suggests rising asset ownership.

- Low awareness:

- PMSBY, PMJJBY, PMFBY, APY awareness is only 30–35%.

- Knowing a claim beneficiary increases the likelihood of adoption.

4. Quality, Financial Literacy & Grievance Redressal

- Customer experience issues: Long wait times at branches; the burden of grievance resolution falls on customers.

- Low complaint visibility at BCs: Indicates under-reporting or lack of mechanisms.

- Mismatch between satisfaction & service quality:

- General satisfaction reported

- But lower satisfaction with staff sensitivity, awareness of complaint process → feedback not aligned with actual service quality.

Principles of Financial Inclusion Highlighted by NFSI 2025-30

- Equitable: Access infrastructure should be available across the geographic strata in a reasonably homogenous manner.

- Responsible: Financial products/services do not manipulate or impede customers’ free choice, interests and right to product suitability and do not leave customers worse off in terms of economic, behavioral and social outcomes.

- Suitable: Financial products/services should be appropriate to customers’ needs and based on customers’ financial circumstances and understanding. Differentiated/customised services should be available to enable people to choose what is best for them.

- Affordable: Basic minimum financial services should be offered free of cost. Pricing of other services should have an essential element of affordability, keeping in mind the marginal cost of services.

- Financial Safety:

- Financial Security:

- Financial Resilience: Ability to recover from financial setbacks by provision of unexpired insurance coverage (life/health/machine, etc.) and emergency credit facilities.

- Financial Discipline: Promotion of attitude and behaviour towards a steady financial future by financial education

Five Strategic Objectives (Panch-Jyoti) for Financial Inclusion Outline by NSFI: 2025-30

Strategic Objective I: Improving availability and use of an equitable, responsible, suitable & affordable bouquet of financial services to achieve financial safety & financial security for households and micro-enterprises

- Improving equity, reach, consistency and quality of last-mile access

- Incentive mechanism for BC agents from hilly & rural areas

- Strengthening the remuneration structure of BCs

- Expanding the scope of services and improve sustenance of BC operations

- Strengthening BC registry

- Expanding Digital Financial Services

- Reaching one billion users in digital payments

- Expanding & Deepening Digital Payment Ecosystem

- Programmable CBDC to facilitate targeted credit flow & expand access

- Unified Lending Interface

- Onboarding of all banks & insurance companies to Jan Suraksha Portal and improving coverage of Atal Pension Yojana (APY)

- Simpler digital interface & Use of AI

- Focused attention on Micro-Enterprises

- Role of Self-Regulatory Organisations

Strategic Objective II: Adopting a Gender-Sensitive Approach for Women-led Financial Inclusion and Differentiated Strategies for Improving Financial Resilience of Households, especially the Underserved and Vulnerable Segments.

- Increasing the share of women business correspondents

- Identification of vulnerable/underserved segments for focused services

- Differential products & delivery channel for vulnerable segments

- Development of suitable bundled products in the investment, pension, and insurance domains.

- Suitable and fair credit products with an easier documentation process and quick disbursals

- Emergency Credit – Overdraft in BSBDAs

Strategic Objective III: Synergising Livelihood, Skill Development and Support Ecosystem and its linkages with Financial Inclusion.

- Content development & Delivery for Skill Training

- Adoption of NSQF by all skilling institutions & availability of course content in all languages.

- Synergise resources for all the skilling institutions with a focus on gender sensitive approach.

- Data Sharing and Reporting on the number and types of skill training conducted

- Dissemination of Information on Skill Loan Schemes of NSDC, GOI, and State Govt.

- Funding & Financial Support to Skill Trained Individuals through the Potential Linked Plan of each district.

- Funding and Financial Support to Skill Trained Individuals through the Potential Linked Plan of each district.

- Leveraging Local Community Organisations

Strategic Objective IV: Leveraging Financial Education as a Tool for Promoting Financial Discipline

- Sustaining & deepening of financial literacy initiatives.

- Differentiated contents & focused delivery channels

- Setting up of Targeted Financial Literacy Units

- Improving Digital Literacy.

- Development & dissemination of content – Sustainable Indebtedness.

- Development and dissemination of contents – Realistic goal setting, financial planning.

- Periodic Assessment of the state of financial literacy.

- Focused awareness initiatives for specific regions/ groups.

- Developing AI & ML-based public query systems on common banking and finance-related aspects.

- Conduct of suitably positioned social media campaigns on consumer protection and grievance redressal measures.

Strategic Objective V: Strengthening Quality and Reliability of Customer Protection & Grievance Redressal Measures

- Improving Grievance Redress Mechanism – Reducing the high customer burden in the redress mechanism

- Simpler solutions

- Effective use of the Citizen Financial Cyber Fraud Reporting & Management System (CFCFRMS) to address cyber fraud complaints

- Board approved Customer Grievance Redress Policy

- Strengthening Customer Protection Measures

- Digital payments intelligence to mitigate payment frauds

- Protection against dark patterns

- Guardrails against tech innovations

- Use of pre-intimated official phone numbers by banks

- Conduct of regular customer awareness campaigns

Way Forward: Strengthening Financial Inclusion in India (NSFI 2025–30)

- Strengthen last-mile banking by improving BC remuneration, service standards and rural coverage.

- Expand digital inclusion via offline payments, vernacular apps and cyber fraud awareness.

- Promote women-led financial inclusion through women BCs and gender-focused financial products.

- Improve credit access using digital footprints, ULI and collateral-free micro credit.

- Link financial inclusion with skilling and livelihoods at the district level.

- Shift to behaviour-based financial literacy using schools, AI tools and local campaigns.

- Strengthen consumer protection through real-time alerts, transparent charges and strong grievance redressal.

- Use data dashboards and FI Index monitoring for evidence-based policy.

- Leverage CBDC, AI and Aadhaar-enabled systems for targeted delivery.

- Improve Centre-State and regulator coordination for implementation.

India–Seychelles Strategic Partnership...

India–Seychelles Strategic Partnership...

Draft Income-tax Rules 2026: Key Propose...

Draft Income-tax Rules 2026: Key Propose...

Network Readiness Index Report 2025: Glo...

Network Readiness Index Report 2025: Glo...