Table of Contents

Context: A few weeks back, India’s Finance Ministry declared the Indian economy to be in a “Goldilocks situation”. More astute observers of the Indian economy with historical data question this so-called golden equilibrium, which disguises underlying structural imbalances.

What is meant by a Goldilocks Situation in Economics?

- Goldilocks Situation in Economics typically features:

- Moderate, sustainable growth

- Low and stable inflation

- Supportive monetary conditions that don’t stifle business or consumer spending.

Why did the government claim India is in a Goldilocks Situation?

The Finance Ministry pointed to:

- High GDP growth: 7.6% in FY2024 — among the fastest globally.

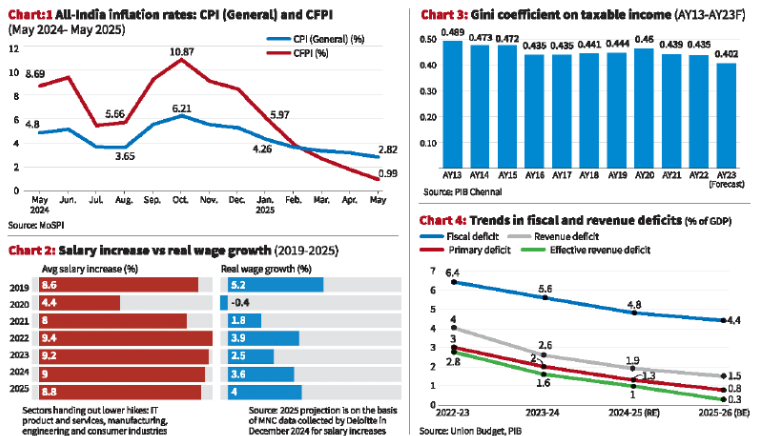

- Low headline CPI inflation: Down to 2.82% in May 2025, within RBI’s target range.

- Peaking interest rates: Monetary conditions expected to ease, aiding investment.

- Stable corporate earnings: Indicating strong business performance.

- Recognition of India’s $3.6 trillion economy with resilient macro fundamentals.

Arguments Against the “Goldilocks” Claim

- Volatile food inflation hurting households: Food inflation (Consumer Food Price Index (CFPI)) has often been much higher than the general Consumer Price Index (CPI), Eg, 10.87% in Oct 2024 vs CPI 6.21%.

- Food forms nearly 50% of average household spending, so this erodes real purchasing power despite low overall CPI.

- Stagnant real wage growth: Nominal salary hikes are offset by inflation — e.g., a 9.2% rise in 2023 gave only 5% real growth.

- Some years even saw negative real wage growth.

- Disproportionately affects lower and middle-income groups, curbing consumption demand.

- Persistent income inequality: Gini coefficient improving on paper, but mostly reflects formal taxable income — informal sector realities are worse.

- Post-pandemic recovery is K-shaped — wealthy prosper, poorer households lag.

- Fiscal constraints: Fiscal deficit still high (projected 4.4% in 2025-26) with public debt-to-GDP ~81%.

- High borrowing risks crowding out private investment and limits social sector spending

Way Forward

- Tame food inflation volatility: Strengthen supply chains, buffer stocks, and crop diversification.

- Better weather risk management.

- Boost real wage growth: Support labour-intensive manufacturing.

- Incentivise MSME growth and skill development.

- Address inequality: Expand social protection nets.

- Invest in universal quality healthcare and education.

- Ensure fiscal sustainability: Gradually reduce deficit without cutting essential spending.

- Broaden tax base and improve compliance.

- Promote inclusive growth: Focus on rural infrastructure and job creation in smaller towns.

- Encourage women’s participation in the workforce.

SEBI’s SWAGAT-FI Framework for Low-Ris...

SEBI’s SWAGAT-FI Framework for Low-Ris...

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...